CNPC, Total ink Iran joint venture

|

|

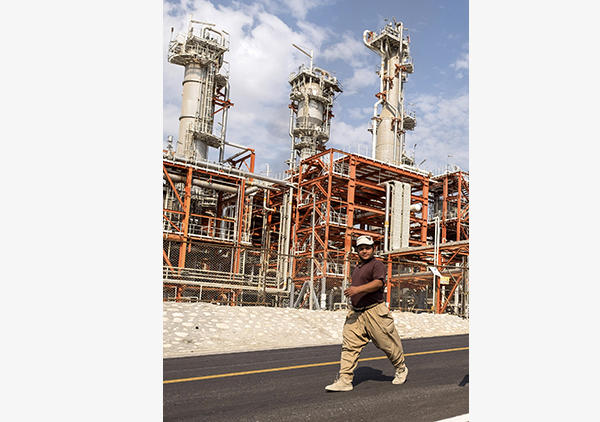

A worker walks at a unit of South Pars Gas field in Asalouyeh Seaport, Iran. [Photo/Agencies] |

JV is the first after United Nations sanctions were eased on Mideast nation

Iran signed a $4.8 billion natural gas development project with energy giants Total SA and China National Petroleum Corp, marking the first joint venture with international partners since UN sanctions on the nation were eased in January.

Paris-based Total will control 50.1 percent in the project, with CNPC taking 30 percent and Iran's Petropars the rest. The deal, for the 11th phase of the offshore South Pars gas field, is still preliminary, with both sides signing a "heads up agreement", according to Gholam-Reza Manouchehri, deputy director of the National Iranian Oil Co.

Total put the cost of the first phase of the project at $2 billion, with Total's share at $1 billion, Chief Executive Officer Patrick Pouyanne said on Tuesday.

"It's definitely in the interests of the country and now the partners to finalize the contract production," he said at a signing ceremony in Teheran on Tuesday.

Iran has the world's biggest natural gas reserves, estimated by BP Plc at 34 trillion cubic meters. The offshore South Pars gas field is Iran's section of the world's biggest deposit, also shared with Qatar. Iran is seeking to revive an energy industry crippled by international sanctions.

The agreement signals that the country is trying to fast-track projects to boost oil and gas production amid low prices, analysts said.

"Iran wants to go very quickly and they are looking to sign agreements as soon as possible," said Homayoun Falakshahi, a specialist on the Iranian oil industry at consultant Wood Mackenzie Ltd in London. The project is the first to be signed with an international oil company since Iran developed new oil contract procedures to attract foreign investment. Teheran earlier signed an agreement with a domestic company, Persia Oil & Gas Co, using the new contracts.

Alastair Syme, an oil analyst at Citigroup Inc in London, described the South Pars deal as "attractive," estimating it would deliver returns of 19 percent for Total. In Iran's previous buyback deals, which foreign groups disliked and which were used in the late 1990s and early 2000s, companies often achieved single-digit returns.

Still, companies are likely to be wary about investing in Iran too quickly, or too much. "While the project terms look attractive, the political history clearly warrants limiting exposure," Syme said.

Total was working on developing the South Pars gas project until sanctions designed to halt the nation's nuclear program forced the company to pull out in 2009. "I thank Total for returning," Iran's Oil Minister Bijan Namdar Zanganeh said.

Bloomberg