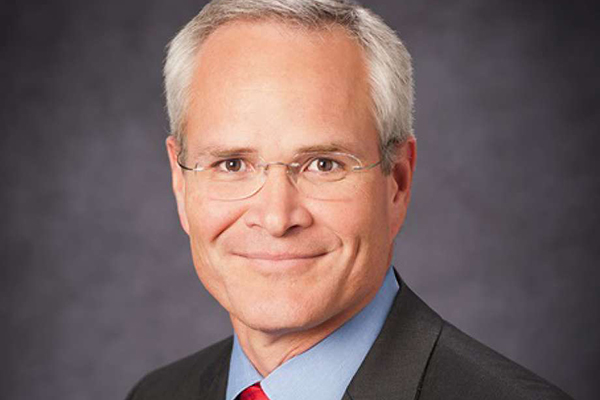

Exxon names Darren Woods as new boss to replace Rex Tillerson

|

|

Darren Woods, newly named chairman and CEO of Exxon Mobil Corp. [Photo provided to China Daily] |

Exxon Mobil Corp named Darren Woods, the heir apparent who built the company's refineries into profit centers, to succeed Rex Tillerson as chairman and chief executive officer, effective Jan 1.

Woods, the company's refining boss since 2012, was elevated after president-elect Donald Trump picked Tillerson to become US Secretary of State, the Irving, Texas-based oil explorer said in a statement on Wednesday.

Even if Tillerson doesn't become the top US diplomat-three Republican senators have expressed misgivings about his nomination-he was due to leave no later than March when he reaches Exxon's mandatory retirement age.

Woods, 51, inherits a drilling and refining behemoth hamstrung by a two-and-a-half year slump in energy markets, and ill-timed investments in North American shale and Russia.

Still, Trump's election, OPEC's plan to cut production and Woods's ability to boost the value of the company's refineries have all combined to change the face of the industry for Exxon heading into the future.

"Validating the integrated model will be the challenge for the next leader of Exxon," said Vincent Piazza, a senior analyst at Bloomberg Intelligence in New York. "Downstream and chemicals have been the few bright spots counterbalancing the negative impact of prices on the upstream segment."

Woods's elevation to chairman and CEO was telegraphed with his promotion to president in January, the same time he became a member of the board of directors. He's been on the six-person management committee that oversees day-to-day operations since June 2014. He steps into the new roles effective Jan 1.

Refining reversal

For the past five quarters at Exxon, refining has outperformed so-called upstream oil and natural gas wells, a reversal of the traditional relationship. Since June 2015, Exxon's refineries and related business lines raked in $6.34 billion, compared with $3.05 billion for the oil and gas business. During that same period, refining burned through $3.1 billion in capital spending, compared with $23.2 billion in the upstream segment.

A Kansas-born electrical engineer by training, Woods joined Exxon as an analyst in 1992 and rose through the ranks on the refining and chemicals side of the business. His main rival in the competition to succeed Tillerson was Jack Williams, a drilling engineer who oversaw oil and gas projects from Louisiana to Malaysia before taking control of XTO Energy, the shale explorer Exxon bought in 2010 for $35 billion.

One of Woods's most-pressing tasks will be figuring out how to rescue a stillborn Russian joint venture that locked up $1 billion in investments and a billion-barrel Arctic oil discovery behind a wall of international sanctions.

Russia quandary

When Exxon signed a 2011 agreement to join with Rosneft PJSC in drilling Arctic, deepwater and shale fields, it was seen as a crowning achievement of Tillerson's career. But the work slammed to a halt when the US and European Union imposed economic sanctions against Russia in 2014. The venture has been mostly idle ever since.

On the home front, Woods will face allegations by attorneys general from New York, Massachusetts and other states that Exxon misled investors about the threat posed to the company's portfolio by climate change. Under Tillerson, the company has aggressively defended its record.

Exxon shares have risen 16 percent this year, lagging the 19 percent advance by the Bloomberg World Oil & Gas Index. Chevron Corp and Royal Dutch Shell Plc have also outperformed their bigger rival, with gains of 29 percent and 40 percent, respectively.

Woods made $28,848 in political contributions during the past four years. The biggest recipient was Exxon's political action committee, which took in $13,700. Woods also gave the Republican National Congressional Committee $10,000.

Exxon's leadership change comes after the Organization of Petroleum Exporting Countries and several non-OPEC nations including Russia committed to cutting almost 1.8 million barrels a day of crude starting next year. Oil in New York has risen about 15 percent to over $50 a barrel since the Nov 30 accord.

Legendary oil tycoon T. Boone Pickens sees crude reaching $60 a barrel within a month, and $75 some time next year. "I'm long oil," Pickens said on Monday.

Bloomberg