China can promote market liberalization, says TheCityUK expert

By Cecily Liu in London (chinadaily.com.cn) Updated: 2016-09-01 18:06

|

|

Gary Campkin, director of policy and strategy at TheCityUK |

While the global economy is affected by uncertainties, including Brexit, Gary Campkin, director of policy and strategy at TheCityUK, said China's increasingly open and liberal markets are providing opportunities and acting as a catalyst for world economic growth and financial innovation.

He said an open trade and investment relationship with China will be especially important to Britain after it leaves the European Union.

"We would value the continuing development of an invigorated trade and investment relationship based on openness of each other's economies," he said. "This would represent a significant contribution from China, which shares the UK's interests in ensuring the process of Brexit leads to a stable outcome for the global economy."

In addition, Camkin said his team also looks forward to China helping to make progress on G20 objectives such as global regulatory coherence, governance and transparency. He said the summit can also play an important role to reach agreement on further steps to ensure increased trade and cross-border investment to stimulate growth and job creation.

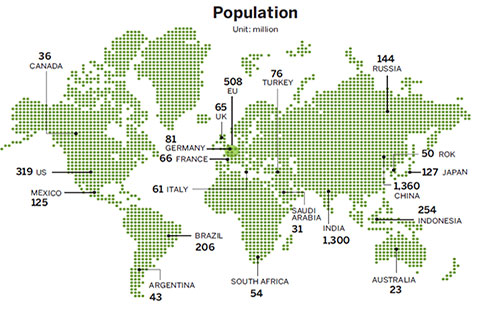

China, as the world's second-largest economy, has the capacity to lead in opening up its markets and encouraging others to do the same, he said, while ensuring that the slowdown in China's economy is moderate.

He said the significance of the Chinese economy globally is emphasized by a forthcoming report by his team, which notes "reliance on Chinese growth has increased vulnerabilities for the global economic and financial system given the mainland's deteriorating demographics, growing debt burden and economic transition".

Overall, Camkin believes the key source of a new round of prosperity is to be created by the dismantling of trade and investment barriers. More specifically, in emerging markets, reform programs will be a key area for discussion and will of course vary hugely from country to country.

In developed markets, weak productivity growth is still an issue and this is something that will no doubt come under scrutiny.

Camkin said the slow down in China's growth after two decades of rapid growth is inevitable, but given China's market size as a major source of demand, its sustained growth will help the world economy to recover.

One key example is the global commodity markets' reliance on China to lead a recovery over the past year.

"China's role as a source of final demand is especially important given the continued mixed pattern of demand elsewhere in the world."

Camkin said the array of actions China has taken to liberalize its financial sector is already really helpful for the world economy, and the effects are already being felt in London.

Key examples include the opening up of China's stock exchanges to foreign investment by establishing a stock connect between Shanghai and Hong Kong, hence allowing Western investors to access China's stock market through Hong Kong.

Another example Camkin referred to is the increasing issuance of offshore renminbi bonds in London, allowing Western investors to increasingly access renminbi investment opportunities.

These initiatives are especially important as the renminbi will be included in the International Monetary Fund's basket of reserve currencies in October, meaning more Western central banks and institutional investors will likely increase their holdings of yuan-denominated assets to benchmark their investment portfolio against the basket.

As strengthening financial sector governance is a key objective for the G20, Camkin said his team welcomes China's involvement in this area.

- China, other G20 members contribute to global financial governance

- BOC plays cupid between Chinese and foreign SMEs for an economic cause

- China's manufacturing IoT spending to hit $128b by 2020: IDC

- G20 coordinators confident of summit's success, accomplishment

- Chinese scenic city Hangzhou enters 'G20 time'

- Press conference of B20 summit held in Hangzhou

- Fourth G20 Sherpa Meeting held in Hangzhou

- Hangzhou: host city of G20 Summit