China' CPI up 0.9%, PPI up 7.6% in March

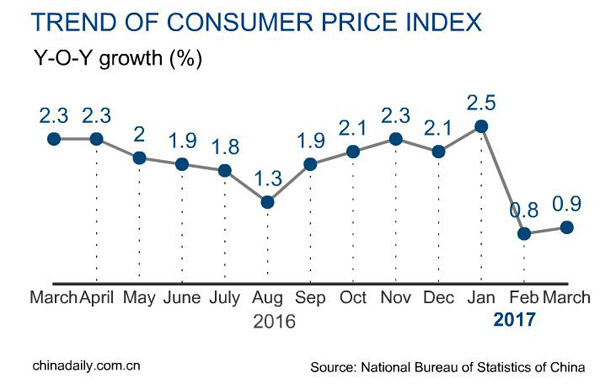

The pace, almost on par with market expectations, quickened from a growth of 0.8 percent in February. On a monthly basis, the CPI declined 0.3 percent, according to the NBS.

The NBS attributed the lower CPI reading on a monthly basis to lower food prices which fell 1.9 percent in March. Vegetable prices dropped the most, by 7.9 percent from that in February.

Non-food costs edged up 0.1 percent from a month earlier, with garment and healthcare prices rose remarkably.

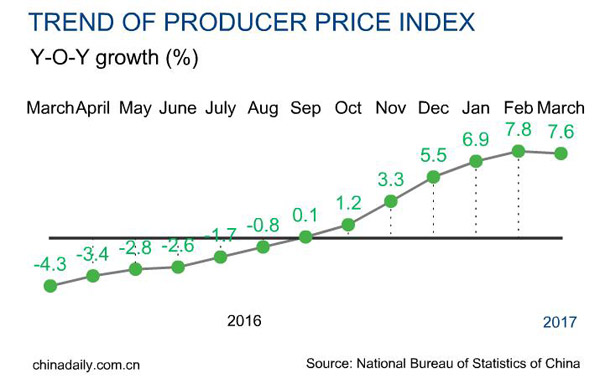

China's producer price inflation slightly eased in March after widening for the past few months as commodity prices moderated, official data showed Wednesday.

China's producer price index (PPI), which measures costs of goods at the factory gate, rose 7.6 percent year-on-year in March, according to the National Bureau of Statistics (NBS).

The pace slightly retreated from the 7.8 percent growth registered in February, which marked the highest since 2008.

In major industries, the upward momentum is seen as moderating. Factory-gate prices in the oil and gas extraction industry went up 68.5 percent, slowing 16.8 percentage points from the rate seen a month earlier, noted NBS senior statistician Sheng Guoqing.

Coal mining prices gained 39.6 percent, with the growth unchanged from February.

China's PPI has stayed in positive territory since September, when it ended a four-year streak of declines, partly due to the government's successful campaign to cut industrial overcapacity, which benefited the wider economy.

Month-on-month, the PPI edged up 0.3 percent, pulling back 0.3 percentage points from a month earlier, the third consecutive month of retreat.

Prices in key industries have shifted downward on a monthly basis, with those of coal mining and oil refining both down 0.6 percent.

"Looking forward, commodity prices are difficult to predict, but a continued slide would push the PPI further off its peak," said Tom Orlik, chief Asia economist at Bloomberg.

Guotai Junan Securities expects the index to gradually cool but still remain at a relatively high level in the coming period.

The PPI figures came alongside the release of the consumer price index, which rose 0.9 percent in March.