Media, entertainment industry growth to exceed global average

China's entertainment and media industry will grow at a compound annual growth rate of 8.3 percent in the next five years prompted by the rise in internet video, internet ads, music, cinema, and video games, said an industry report.

According to PwC's global entertainment and media outlook 2017-21, the growth rate is much higher than the global figure of 4.2 percent.

China's box office revenue continues to flourish, with revenue growth estimated at 11.6 percent annually to reach $10.7 billion by 2021, up from $6.2 billion recorded last year.

Cinema advertising revenue is increasing rapidly and expected to be worth $939 million by 2021, up from $587 million in 2016.

Cinema construction in China continues to expand at a rapid pace. In 2016, China's total number of cinema screens exceeded those in the United States.

China had 41,056 cinema screens in 2016 compared to 40,928 in the US.

China will have 80,377 screens by 2021, the most in the world, compared with 42,643 in the United States by then.

By 2021, China will rank first globally in the number of IMAX 3D screens, with 575 IMAX 3D screens to be built in China by 2021, up from 296 3D screens in 2016.

Mobile internet advertising revenue in China will overtake wired internet advertising in 2019, an increase from $15.4 billion in 2016 to $38.7 billion in 2021.

Total internet advertising revenue will continue to grow at 12.6 percent annually to reach $68.0 billion in 2021.

"Mobile advertising has huge growth opportunities in China, with social media being a key driver," said Brian Choi, PwC China entertainment and media partner.

China is the largest internet advertising market in Asia and the second-largest market globally after the US. In 2016, China had a 19.8 percent share of total global revenue worth $37.5 billion.

With policy and financial support from the government, China's video game industry continues to grow rapidly and is starting to mature.

In 2016, total video game revenue was $15.4 billion, and is forecast to grow at 11.2 percent to reach $26.2 billion in 2021, making China the second-largest video game market after the US.

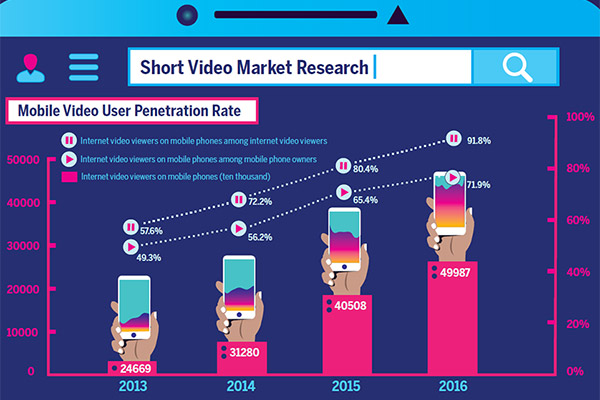

Total internet video revenue in China reached $1.8 billion in 2016. Total consumer spending on internet video is forecast to reach nearly $4.5 billion in 2021.

In China, technology shifts will transform both the content creation and distribution model that revolve around innovating and improving the user experience, said Wilson Chow, PwC's TMT leader for the Chinese mainland and Hong Kong.

He said investment in data collection and data analytics will facilitate better understanding of the behaviors and preferences of users, which helps players to identify a community of active and high value "fans" of their services or products.

To cope with the challenges of a shifting consumer mindset and consumptions, companies should embrace technology in order to improve product quality and the user experience, said the report.