Honor of Kings a king-size hit

|

|

Professional Honor of Kings players from the ASGARD Xiange team celebrate after winning Tencent's 2016 King Pro League Finals in Shanghai last December. [Photo provided to China Daily] |

Fantasy game has generated billions of yuan for online giant in China

"Turn on the microphone." Nie Chenjing has typed those words on her smartphone so many times that they are etched in her psyche.

A late convert to Honor of Kings, the 25-year-old spends an average of one-hour-a-day on the online fantasy blockbuster.

She started playing the jewel in the gaming crown of Tencent Holdings Ltd last summer to help expand her social networking circle.

"It's easy to learn and so convenient," said Nie, a new media editor. "It's also a good way of staying in touch with friends and making new ones on social networks."

Honor of Kings has broken records and gender barriers as it swept across the country. A "make believe" battle craze for smartphones, it has captured the imagination of Millennials, or the under-30 generation.

It has also made big bucks for internet giant Tencent, raking in revenue of more than 5.5 billion yuan ($810.47 million) in the first quarter, Chinese gaming industry database Gamma Data Corp estimated.

To put that into perspective, the country's mobile gaming revenue jumped by 4.5 billion yuan to 27.5 billion yuan during that period. It was the biggest increase in growth for two years.

"And this market will continue to grow," said Teng Hua, founder of Gamma Data, a next generation data management company based in Beijing.

For Honor of Kings, Gamma Data revealed that players pay an average of 11 yuan-a-month to upgrade their game characters and costumes to help them advance to the next level.

This has translated into hefty profits for Tencent as a report by Chinese mobile data intelligence firm Jiguang showed that Honor of Kings doubled its monthly active users to 163 million in May since December 2016.

The rise has been fueled by a young generation that earns less than 8,000 yuan a month. Data also showed that 54 percent of the 200 million gamers are young women such as Nie.

"It's easy to learn and so convenient," she said. "You simply click on the app and you can play it anywhere with your friends.

"We even call each other by the names of the heroes we are using in the game instead of our real ones," she added.

Social networking is a key part of Honor of Kings' appeal to young women, according to Gamma Data. The game offers a platform for entertainment and communication, it pointed out.

Naturally, this has made the smartphone phenomena a worldwide hit. App tracker App Annie confirmed that Honor of Kings topped the global rankings for monthly revenue in May on both the App Store and Google Play.

"A major factor in its success is the billion-plus users on Tencent's social networking platforms WeChat and QQ," said Dong Zhen, interactive entertainment analyst at internet consultancy Analysys in Beijing.

"For smartphone users, it helps them kill spare time," he added.

The runaway success of Honor of Kings has also spawned an army of similar productions.

Another popular role-playing game is Onmyoji, which was rolled out by NetEase Inc, an online company based in Hangzhou. So far, it has attracted about 15 million monthly active users.

Monthly revenue for the game is projected to reach 900 million yuan compared to Honor of Kings' 1.8 billion yuan, a first quarter report by Gamma Data highlighted.

|

|

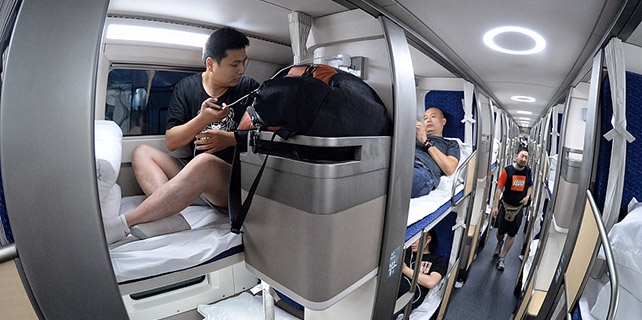

A competitor plays Honor of Kings during the 2017 King Pro League Spring Season in Shanghai in April. [Photo provided to China Daily] |

Zhai Li, 29, a digital product manager in Beijing, has spent nearly 10,000 yuan on Onmyoji upgrading his characters and buying game currency to purchase props that will help him advance to another level.

"I love the Japanese-style game and its teamwork model," said Zhai, who spends more than two hours playing the game every day. "I don't mind spending money as it gives me a better user experience."

In a global market report from research group Newzoo, mobile gaming is projected to generate $46.1 billion this year, accounting for 42 percent of all gaming revenue. By 2020, mobile gaming is predicted to account for 50 percent of the market.

Gaming in China is also expected to generate $27.5 billion with most of it coming from the mobile market.

"The rapidly growing mobile gaming sector in China is fueled by a large user base," said Teng of Gamma Data. "It is increasing each year but eventually it will grow more slowly and developers will need to seek new areas of expansion."