Luxury labels get an online makeover

|

|

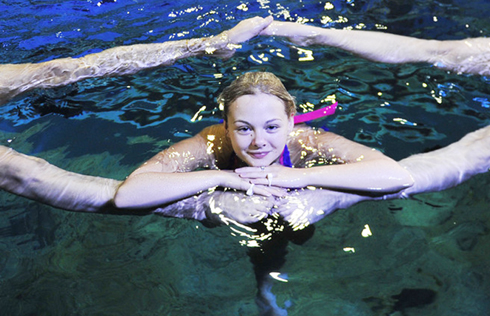

A Tmall mascot poses with a Maserati SUV Levante 350HP in Hangzhou, Zhejiang province, after the luxury carmaker sold its first 100 models on the Alibaba online platform. Starting at 999,800 yuan, Maserati sold all 100 cars in 15 minutes last year. [Xu Kangping/for China Daily] |

JD Fashion and Alibaba's Pavilion site battle it out to showcase blue chip brands as they root out internet fakes

Luxury labels are at the center of a new online battle between Chinese internet giants looking to cash in on the consumer craze for designer fashion.

Big players such as JD.com Inc and Alibaba Group Holding Ltd are going head-to-head to capture a market which is worth billions of dollars a year.

In a move to dominate the industry, JD Fashion was rolled out earlier this year.

Then in June, parent company JD.com announced a strategic partnership with Farfetch UK Ltd by taking a $397 million stake in the London-based online fashion group.

Two months later, Alibaba hit back by launching the Luxury Pavilion site for blue chip brands on its e-commerce platform Tmall.

"We are making a major push in fashion this year," said Liu Hong, general manager of jewelry, luxury goods and accessories at JD Fashion. "The next frontier of e-commerce is fashion and we plan to win it."

Less than a decade ago, the majority of top-of-the-range labels were bought by Chinese consumers when they traveled abroad.

Many were personal shoppers, who would bring back preordered designer brands to avoid custom tax, a practice known as daigou.

But those days are being consigned to history as high-end retail districts sprout up in major cities, such as Beijing, Shanghai, Guangzhou and Shenzhen, catering for the affluent middle class.

A report by the consulting firm Bain & Co showed that China remains an "engine of growth" for luxury fashion items, capturing 30 percent of the global market last year, which was a slight decrease compared to 2015.

Still, in another research document, KPMG, one of the big four global auditors, revealed that up to 50 percent of domestic luxury consumption in China will be generated online by 2020.

With eye-watering figures like these being bandied around, it is hardly surprising that JD.com and Alibaba are starting to make waves in the sector.

"The newly-created JD Fashion is a separate business unit with a staff of more than 1,000 people, which demonstrates our commitment to this market," said General Manager Liu.

To help mastermind the operation, the e-commerce juggernaut brought in Winston Cheng to spearhead its international business development.

He had previously worked for LeEco, the multinational electronics conglomerate based in Beijing.

"We are putting resources into Europe and the United States to win over brands, and prove how serious we are about the luxury sector," Liu said.

Already JD.com has lined up leading labels, such as Swiss watch maker Zenith and Austrian jeweler Swarovski, as well as Trussardi and Tag Heuer.

The deal with Farfetch in the UK has further strengthened its grip on the industry.

JD.com has even wheeled out a "white glove" express delivery service in which smartly dressed couriers in electric cars drop off purchased items to customers.

"Luxury fashion brands will see that we really understand them," said Liu, adding that the company plans to roll out more initiatives without going into details.

Last year, China's cross-border e-commerce import transactions reached 1.2 trillion yuan ($180.2 billion), an increase of 33.3 percent compared to 2015, a report released by China E-Business Research Center revealed.

This year that figure is expected to increase by 54.5 percent to 1.85 trillion yuan.

With so much at stake, Alibaba has been quick to take up the challenge by launching Luxury Pavilion.

The new site on Tmall features an array of designer labels from apparel, perfumes and beauty products to watches and jewelry from Burberry, Hugo Boss and LVMH-owned marque names Guerlain and Zenith.

Part of Luxury Pavilion's appeal is that leading labels can launch their "official stores" on the site and run the businesses on a daily basis.

"Luxury brands increasingly want to use new retail technology and consumer insight to connect with younger shoppers, as well as drive business-model innovation," said Liu Xiuyun, the head of Tmall's fashion business.

Combating counterfeit brands has also become a priority with JD.com taking a tough stance by controlling inventories and vetting retailers on its fashion site. The move has paid off.

"As a testament to our commitment to authenticity, we have become the first and only Chinese e-commerce company to join the American Apparel& Footwear Association, where we will work with them on intellectual property issues," General Manager Liu said.

Alibaba has gone down a similar road to beat the "pirates".

Earlier this month, the online giant joined forces with the Kering Group to weed out counterfeit brands.

The French company based in Paris owns labels such as Gucci, Yves Saint Laurent, Balenciaga, Alexander McQueen and Bottega.

Protecting those intellectual property rights in China has become a priority as the group rides a new wave of online shopping.

"Luxury brands are catching on and e-commerce is the next frontier for growth in a crucial market," said Liz Flora, editor of the Asia Pacific region for market research company L2.

But the problem of fake labels has left many online shoppers wary of buying luxury items, Lu Zhenwang, CEO of Wanqing Consultancy in Shanghai, stressed.

"Making sure the authenticity of luxury products will boost customer confidence in China (and increase sales)," Lu said.