ODI drops on halt to irrational activity

Ministry says it found no new spending in sport, real estate in first eight months

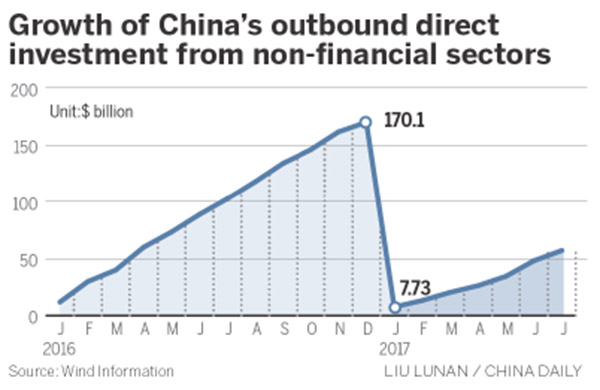

China's outbound direct investment from non-financial sectors dropped 41.8 percent year-on-year to $68.72 billion between January and August, as the country halted irrational investment activities since the end of 2016, the Ministry of Commerce said on Thursday.

The drop in the country's ODI during this period narrowed from the 44.3 percent year-on-year decline in the first seven months to $57.2 billion.

Commerce Ministry spokesman Gao Feng said the government found no additional investment in sports, real estate and entertainment business in the first eight months, and these sectors are not easy to supervise and prevent from criminal activities.

"The majority of China's ODI mainly, in the meantime, entered sectors including commercial leasing, manufacturing, wholesale and retail, information transmission and technology in the global market, indicating that the country's ODI structure has further been optimized and become more commercialized and technology-based," said Gao.

"Chinese companies are now paying more attention to physical investment as the declines in overseas manufacturing industries were smaller compared to those in the property, culture, sports and entertainment sectors," said Ma Yu, a senior researcher at the Chinese Academy of International Trade and Economic Cooperation in Beijing.

Since late 2016, government agencies such as the State-owned Assets Supervision and Administration Commission and the Ministry of Commerce have been reinforcing inspection of authenticity and regulation compliance of ODI to improve profit and control risks.

In the latest efforts, the central government decided to limit ODI by domestic companies in several fields, including real estate and sports clubs, while encouraging them to invest in infrastructure and new technology.

Companies from China invested in 4,789 firms in 152 countries and regions from January to August and signed $149.57 billion in new contracts for overseas projects, a rise of 12.7 percent year-on-year.

The ministry said China will continue to tighten its review of the authenticity of overseas investment and its compliance with regulations, and guide more investment into the real economy and reduce investment in sectors in which Chinese companies are not proficient at managing.

Meanwhile, outbound investment to 52 economies involved in the Belt and Road Initiative stood at $8.55 billion, accounting for 12.4 percent of total ODI, up 4.3 percentage points year-on-year.

"The infrastructure development related to the initiative will require a high degree of coordination between and among states, the private sector and the civil society, as well as vast investments of capital and material resources," said Zhang Yansheng, deputy director of the expert committee of the China Council for the Promotion of International Trade.

"Therefore it is necessary for governments and companies engaged in the initiative to have a clear understanding of the key factors in driving success."