Terrific push for trade

|

|

A China Railway Express worker directs loading of cargo at Yiwu, Zhejiang province, which now has rail links to the European market. [Photo by Zhu Xingxin/China Daily] |

Easier customs, facilitation pacts, FTAs, MoUs... China's growth pursuit gets a fresh set of teeth

High growth-minded China is turning its economic spotlight on trade again, after sustained emphasis on supply-side reform.

Cuts to overcapacity in certain sectors and rationalization of companies in key industries are still important. But the country will also help with more negotiations on trade facilitation agreements with foreign countries, including Canada and Israel, according to officials.

There's more to the trade push, of course.

China will simplify and reduce administrative approval procedures related to customs declaration and clearance, and speed up the establishment of a framework for relevant laws and regulations.

General Administration of Customs spokesman Huang Songping said the government will cut the time for cargo clearance by over 30 percent this year.

To raise the efficiency of customs procedures, free mandarin lessons will be given to dialect-speaking domestic business owners and their staff.

"China will further crack down on smuggling of foreign agricultural products and the import of prohibited foreign garbage including plastics, slag from steelmaking, vanadium slag, unsorted scrap paper and discarded textile materials this year to ensure a healthy growth of the country's foreign trade," said Huang.

"Rising demand for goods in overseas markets, high-tech trading of products, the Belt and Road Initiative and growing confidence will build a solid foundation for China's foreign trade this year," said Wang Shouwen, China's vice-commerce minister.

"Deepening technological progress and economic globalization present to all countries unprecedented opportunities and an urgent necessity to enhance economic and technological cooperation," said Wang.

The Ministry of Commerce plans to assist manufacturers in identifying "specific regions" in key emerging export markets, particularly in BRICS economies like Brazil, Russia and South Africa, and markets related to the Belt and Road Initiative, to further diversify and expand trade ties.

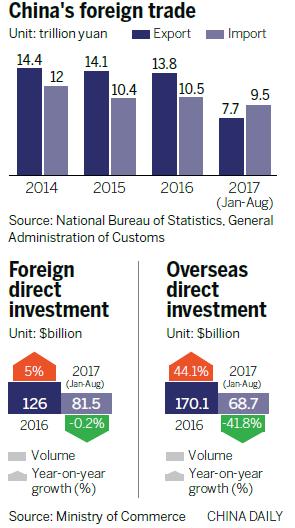

China's export growth eased for the second consecutive month in August to 6.9 percent in yuan-denominated terms, down from 11.2 percent in July, as global demand softened, according to data released by the GAC.

Imports showed stronger growth than exports, at 14.4 percent in August, though a bit down from 14.7 percent a month earlier, which experts said suggests consolidated domestic demand.

|

|

Dock workers wait for the departure of a cargo ship in Qingdao Port, Shandong province, in East China, which is a major trade enabler. [Photo by Yu Fangping/For China Daily] |

In the first eight months of this year, total exports rose by 13 percent year-on-year, while the growth rate of imports was 22.5 percent.

"It's 'an onerous task' to tackle uncertainties and maintain the trade growth momentum, with growing protectionism as well as factories and orders leaving China for lower-cost countries," said Li Guanghui, vice-president of the Chinese Academy of International Trade and Economic Cooperation in Beijing.

Li said China needs to accelerate the upgrade of its foreign trade structure by developing high-tech, high-quality products and services.

Commerce Ministry Spokesman Gao Feng said China, eager to restore its trading ability, will continue to optimize its range of products and approach to the global market through new trade routes and regional cooperation arrangements.

The country has reached 15 free trade agreements or FTAs with 23 countries and regions. It also launched feasibility studies on FTAs with Canada and is willing to conduct another one with Mexico to boost trade with the North American economies.

China and the Maldives also concluded FTA negotiations last month.

"It has been a year since the global trade recovered and it has passed its peak moment. From the export data for August, the growth speed from countries including South Korea and Vietnam has slowed down, indicating the heat of trade recovery is retreating," said Gai Xinzhe, an economist with Bank of China.

"We need to keep a close eye on the economic recovery in Europe and the United States. The appreciation of the renminbi will also have a certain effect on exports, but not too big, because the appreciation in the Chinese currency this time is mainly due to the devaluation of the US dollar," said Gai.

Zhang Yongjun, a researcher at the China Center for International Economic Exchanges in Beijing, said seasonal typhoons also played a role in the slower export growth rate.

For instance, the typhoon in August has had a negative impact on the loading process at ports in both the Pearl River Delta and the Yangtze River Delta regions.

"The import scene remains promising as the demand and price of big commodities have been rising. It also showed the recovery in the domestic market has stayed steady, and a 10 percent growth is expected by the end of this year," said Zhang.

Despite some negative factors, there is still a strong push for exports as Europe, the US and Japan have seen their economy picking up. It is highly likely to achieve an 8 percent growth in exports by the end of this year, experts said.

"China is no longer betting on exports to drive up the economy, cultivating new growth points in technology upgrades, stimulation to domestic consumption and adequate investments in fast-growing sectors in global investment destinations-they have all become indispensable parts for the country to boost its economy," said Wang Huiyao, president of the Center for China and Globalization.

Simultaneously, China is stimulating growth by focusing on supply-side reform. Its efforts in this endeavor can be of great benefit for countries worldwide that are striving to get their sluggish economies back on track.

The reform is aimed at cutting low-end industrial capacity while increasing high-tech production and cultivating new market growth points.

Wang said the services sector has become an important driver of China's economic growth and has great significance for the next step in economic restructuring.

Toward this end, China and Brazil signed a memorandum of understanding in August to diversify services trade to upgrade their commerce structure from commodity and goods exchanges.

Services trade refers to the sale and delivery of an intangible product, such as tourism, financial services and telecommunications services.

Eager to enhance their earning ability in the Chinese mainland, US companies are adopting new strategies. For instance, US-based coffee chain Starbucks Corp plans to open 500 stores this year in China, its largest overseas market, and aims to create 10,000 jobs a year until 2019.

Uber Technologies Inc, the ride-hailing company based in the US, has also committed to invest $1 billion in China to diversify its business, which ranges from transportation services to automotive financing.