Sany's IoT platform gains wide acceptance

Sany Heavy Industry Co, one of China's biggest construction machinery manufacturers by production volume, is diversifying into the internet of things, or IoT, area to exploit opportunities presented by the advent of artificial intelligence or AI.

He Dongdong, Sany's senior vice-president, leads the company's open industrial IoT platform, the country's first, called Irootech Technology Co Ltd, of which he is the chief executive officer.

Currently, Irootech links over 3 million machines across energy, textile, automobile, agricultural and machinery industries.

He said the IoT will bring revolutionary changes to the heavy equipment manufacturing sector from a long-term perspective.

"The cloud (computing segment) is like a mega-brain that connects countless machines, gathering all kinds of information, and provides optimized decisions based on the database, in a way the human brain cannot achieve," he said.

"What we do now is analyze big data, make models and verify it, which could take up a whole year to set up a model. With the help of AI, the modelling can be much quicker."

Sany funded Irootech with 1.5 billion yuan ($250 million) in 2016. According to He, with the IoT being connected to the manufacturing sector, it can raise profit by 10 percent to 50 percent.

Irootech has recently forged partnership with the country's telecom giant China Unicom in its iRoot Cloud platform, the open industrial data cloud that can connect numerous data from machine tools for optimized solutions.

"Industrial solutions are a major part of Unicom's business, and telecom is also a vital part for IoT. It can connect clients and markets," said He. "Irootech will be a bridge that connects manufacturers with the solutions Unicom provides."

Eager to compete with established rivals, the privately owned Sany, which has its main base in Hunan and corporate headquarters in Beijing, has forged partnerships with Tencent Holding Ltd and China Mobile Ltd.

The IoT is becoming a key business for Sany along with new energy, mainly wind power and industrial projects, suggesting the manufacturer's diversification is in line with that of global industrial giants such as US-based General Electric Co and Germany-based Siemens AG.

He said sufficient digitalization can strengthen applications of AI, but traditional sectors like heavy equipment manufacturing are lagging in this respect.

He, however, said companies are seeking to increase digitalization and use AI to revolutionize manufacturing.

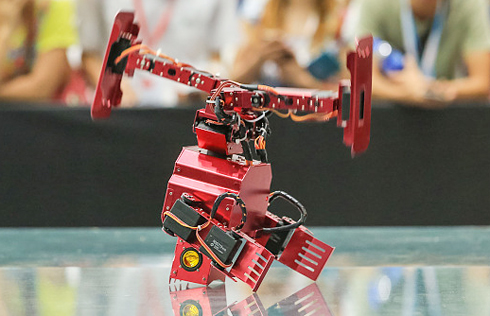

Zhu Sendi, a consultant with the China Machinery Industry Federation, said intelligent manufacturing and robots are vital for the "Made in China 2025" strategy to succeed.

"Most Chinese manufacturing companies are still at industry 2.0 phase, in terms of technology. The ones who are working on industry 4.0 need to lead and guide the small ones to upgrade."

He said companies should not adopt intelligent manufacturing blindly but only if such technologies can be used to become more efficient and productive. For small companies and startups, collaboration with domestic and international industry leaders is crucial, he said.