Shanghai bourse planning more overseas alliances

Exchange intends to be leading global hub for financing and investment

The Shanghai Stock Exchange will deepen collaboration with overseas markets and remain more accessible to global investors, a top official said.

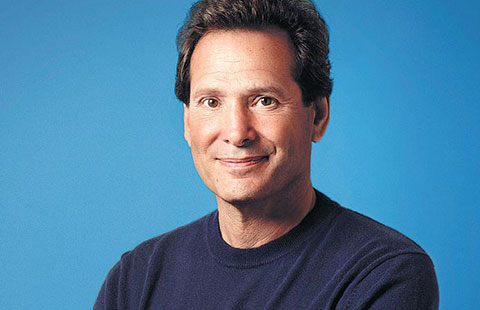

Wu Qing, president of Shanghai Stock Exchange, said the moves are an indication of the bourse further opening up and in line with its plan to be a world-class bourse.

The Shanghai bourse will become a hub for financing and investment, supporting the growth of enterprises and meeting investors' demands for diversified investment tools.

"We want to become a sustainable bourse that supports the growth of enterprises, especially in new economy, new models and new technologies, as well as the transformation and upgrading of traditional sectors", he said.

The bourse has also been making steady progress in its talks with the London Stock Exchange for a stock interconnect, said Wu. He said that there is currently no timetable yet for the planned program, but discussions on the operational practices have made "good progress".

Shanghai Stock Exchange holds an 8 percent stake in the Pakistan Stock Exchange and 40 percent share in the China Europe International Exchange AG in Germany.

"We are also looking forward to the launch of a bourse in Astana, Kazakhstan at the end of this year in which the Shanghai bourse will hold a 25 percent stake," said Wu. One of the functions of this bourse is to serve the funding and investment demands in alignment with the Belt and Road Initiative, he said.

Capital market connectivity is a natural trend for the Shanghai exchange and the bourse wants to become a leading hub for financing and investment in the next decade. It is currently ranked fourth among all bourses in terms of total market valuation, third in total funds raised and second in the number of initial public offerings, according to the World Federation of Exchanges.

Some 1,370 companies with total market valuation of 28.31 trillion yuan ($4.27 trillion) were listed on the SSE by the end of October this year.

"We will encourage more companies to choose Shanghai as a place for financing through equities and bond issuances," said Wu.

In March 2017, Russia's company UC RUSAL, the world's second largest aluminum supplier, became the first company from a market involved in the Belt and Road Initiative that issued renminbi-denominated bonds at the Shanghai Stock Exchange. The initial issuance was 1 billion yuan out of a total planned 10 billion yuan.

"The Shanghai bourse's opening up and achieving a strong position in the international capital market is in alignment with the global use of renminbi, stable and steady development of exchange mechanism, and development and innovation of financial products," said Wu.

He said the exchange has also taken steps to further develop the derivative market.

At the same time, to play well its regulatory role, SSE will continue to strengthen regulations through the disclosure system to ensure a fair and transparent trading environment.