China's debt level not a concern for the short term

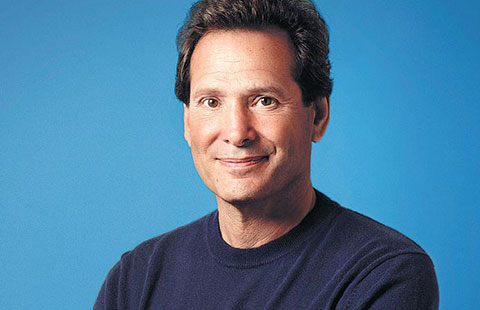

China's level of debt-to-GDP is not a big issue in the next three to five years, said Alan Oster, a group chief economist at National Australia Bank Limited.

"I was at a Bank for International Settlements meeting and people talked about, 'Is China going to have a hard landing?' After two days, I think everyone agreed that was the wrong question. The right question is, 'When the economy starts to have some problems, what will the Chinese do?'" said Oster at a media briefing during his visit to Beijing Monday.

"The Chinese will have a lot of ability to use the reserves they've currently got. China will have enough instruments to generate a reasonably strong ongoing growth and therefore, the issue (of debt level) is more medium term, not short term."

Looking 10 to 15 years ahead, he said the Chinese authorities need to continue to push reforms, shut down de facto defunct State-owned enterprises and make banks recognize nonperforming loans.

He noted that China is seeing capital inflows, thanks to the gradual opening up of its capital markets, especially the huge bond market, and moves to stabilize the economy.

The gross domestic product of China expanded 6.9 percent year-on-year to 59.33 trillion yuan ($8.93 trillion) in the first three quarters of 2017, according to the National Bureau of Statistics.