Unified credit rating system expected soon, say experts

A unified platform for collecting personal financial information and assessing people's credit ratings is being planned, and it is expected to be launched soon as a part of the central bank's regulatory framework, experts told China Daily.

It will complement the existing credit center of the People's Bank of China, the nation's central bank. The center covers data from most of the traditional financial institutions-to especially supervise and assess personal debt level from peer-to-peer lenders and some fintech companies, according to experts.

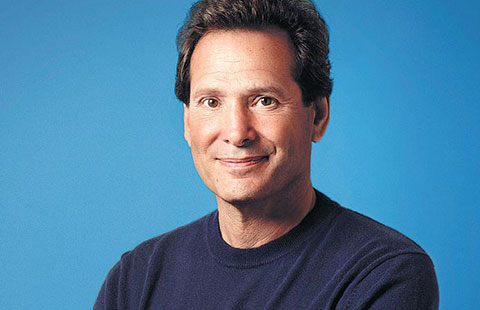

Tang Ning, founder and CEO of CreditEase, a US-listed Beijing-based financial technology conglomerate, who is also head of Beijing Internet Finance Industry Association, told China Daily that a national credit information system is expected to be built soon, which will contain non-banking personal financial trading data and individual credit records.

"It will support the stable development of fintech and peer-to-peer lending in the next decade, preventing a personal credit crisis, such as in South Korea and China's Taiwan," Tang said.

"Building this system is the priority at the moment, rather than stimulating financial innovation or promoting financial firms' IPO issuance," he added.

Besides numerical data, pictures, video and chatting records are possible resources that could be used to evaluate personal credit ratings by the new platform, said Li Honghan, a researcher with the International Monetary Institute of Renmin University of China.

Setting up this platform means tightened regulations by the central bank on personal borrowing activities, to prevent potential risks arousing from internet financing and to curb the fast growth of residential leveraging, Li said.

Recently, the intense expansion of consumer loans mostly from online micro-financing platforms has raised concerns among financial regulators, worrying that a high leveraging level may lead to the exposure of a "Ponzi scheme".

Some third-party credit information service agencies may share information with the regulators about their borrowers' credit rating, Wan Cunchun, director of the credit management bureau of the central bank, was quoted as saying in an earlier report by local financial media Caixin.

Both the central bank and the National Internet Finance Association of China didn't deny this information, but refused to make further comment.

On Nov 3, the National Development and Reform Commission and the central bank jointly issued guidelines on enhancing credit management work by creating two lists: a "red" one for institutions with high credit ratings and a "black" one for those with a high default risk.

The guidance also highlighted privacy protection to avoid illegal data leakage.

Chen Yulu, vice-governor of the central bank, said earlier this year that to build a personal credit information system, it is important to push forward the process of establishing a broad social credit system. Some incentive or punishment measures could be taken based on one's personal credit situation, he said.