'Rebalancing and renormalization' are center of challenge

By Zheng Yangpeng (China Daily) Updated: 2015-03-21 08:02

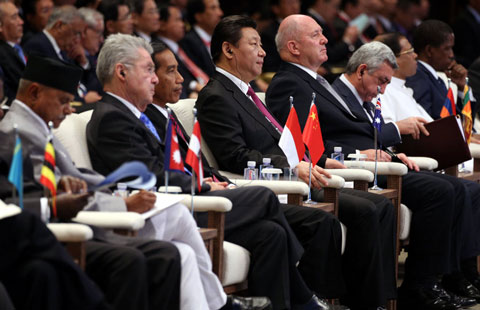

As Martin Wolf, chief economics commentator at the Financial Times, talked with China Daily, the US Federal Reserve was about to publish its statement and the world was watching to see if the Fed would raise interest rates.

Anticipation of rate hikes has pushed up the value of the US dollar. The yuan has already been weakening against the dollar for a while, and economists have talked about the risk of a capital outflow.

Wolf said that even if the Fed decides to raise rates, probably in the summer or early fall, interest rates would remain quite low for a long period and "the exchange rate can't be used as a major way to reignite growth in China".

"It's been my view for a very long time that China is too big to be on the basis of an export-led growth," he said.

One of the world's most influential writers on economic matters, Wolf is also an avid reader of the Chinese economy. He believes the problems confronting the country are almost entirely domestic, and not external.

The centerpiece of the challenge, he said, is that China is engaged in a very complicated "rebalancing and renormalization" of its economy, which is more complicated and difficult than expected.

As the economy slows from 30 years of 10-plus percent growth to 7 percent, to make that work in a stable manner requires a very major shift in the pattern of spending and income distribution toward households and consumption, he said.

China has to "make some sensible compromise" between the goals of growth and deleveraging. That is not necessarily an "either, or" trade-off, but "maybe in the end the growth will slow a bit, and the debt will rise a little more. We've seen in the Western world that getting growth back with a shrinking debt is quite difficult. It will be difficult for China too.

"I personally think the challenges China's economy now confronts are possibly the most difficult challenge since the reform and opening-up began," he said.

In order to achieve its target of around 7 percent growth, China will have to "restart the investment-led and the debt-fueled growth model", and that would not be sustainable.

"While you can get 7 percent growth this year, the cost of achieving that growth next year will be even larger," he said.

If everything goes well, it will take about a decade until China becomes an economy in which consumption takes a much larger share, and growth is led by innovation and competitive private enterprises.

In that decade, there will be a few difficult years when growth is below target, he said, but that "need not to be a catastrophe as long as reform and adjustment happens."

- Israel requests to join Asian Infrastructure Investment Bank

- Chinese stocks rebound on April 1

- China, the West in Africa: more room for cooperation than competition

- Nanjing cuts taxi franchise fees

- Air China increases flights to Milan, Paris

- JD.com raises delivery charges

- Veteran corporate strategist upbeat about China economy

- L'Oreal China sales revenue up 7.7% in 2014