Slowdown curbs Q1 lending activity

By Gao Changxin and Xie Yu in Shanghai (China Daily) Updated: 2014-04-16 07:06

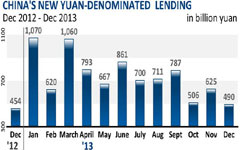

On a month-on-month basis, the March money supply and banking figures point to a mild rebound in growth. New yuan loans were up slightly to 1.05 trillion yuan ($169 billion) in March from an average of 981.8 billion yuan in January and February.

Total social financing came in higher than expected for March at 2.07 trillion yuan, up from an average of 1.76 trillion yuan for January and February.

|

|

|

|

"The trend of a lending slowdown is clear in the first-quarter statistics, but it remains better than expected. In general, demand for credit is shrinking, mainly because of the gloomy prospects of the real estate industry and a decline in credit demand from local government financing vehicles," said Xu Bo, an analyst with the Financial Research Center at Bank of Communications Co Ltd.

Barclays Plc said in a note that it lowered its first-quarter growth estimate to 7.2 percent from 7.3 percent, which implies a sharp slowdown in growth momentum to 4.6 percent quarter-on-quarter.

But it added that momentum will pick up in the second quarter.

The better-than-expected March new loan and total financing support the view that financing channels remain open to stabilize growth as demand recovers. We expect this improvement to continue in the second quarter, said Barclays.

Zhang said that growth likely slowed to 7.3 percent in the first quarter and will slow further to 7.1 percent in the second, partly due to weak momentum in the property sector.

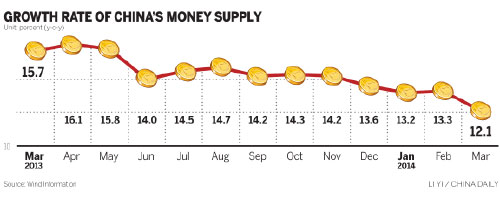

Without a cut in the required reserve ratio, Zhang added, M2 growth is likely to slow further, with GDP growth possibly dropping below 7 percent in the second or third quarter.

- China's power consumption rises 5.4% in Q1

- Canadians sign nuclear MOU

- Higher-value exporters survive turmoil in market

- Pollution discharge fees to rise dramatically

- Shanghai's worsening smog blamed on industry, vehicles

- Bear bile farm makes switch to rescue center

- Some consumers not protecting their rights

- Ernst & Young identify new media trends