|

|||||||||||

|

Major Macro Economic Statistics

|

||||||||||

| Growth indexes | Price indexes | ||||||||||

| Industrial output: +13.3% | CPI: +5.5% | ||||||||||

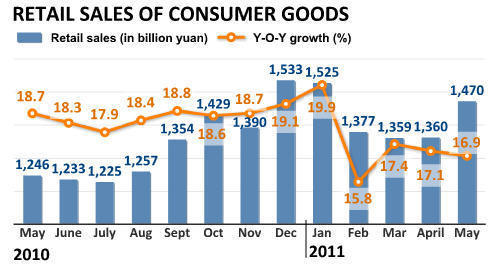

| Retail sales: +16.9% | PPI: +6.8% | ||||||||||

| Urban fixed-asset investment: +25.8% | PMI of manufacturing: 52% | ||||||||||

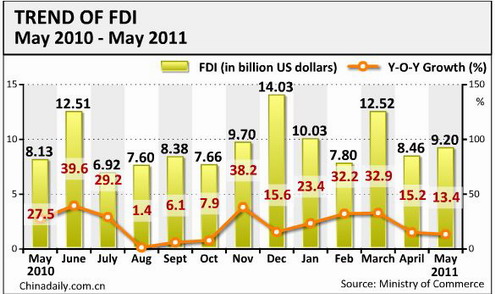

| FDI: +13.4% | |||||||||||

| Electricity use: +10.8% | Foreign trade indexes | ||||||||||

| Financial indexes | Import: $144.1b | ||||||||||

| New loans: 551.6b yuan | Export: $157.2b | ||||||||||

| M2: +15.1% | Trade surplus: $13.1b | ||||||||||

| Fiscal revenue: +34% | |||||||||||

| Data and Graphic | |||||||||||

|

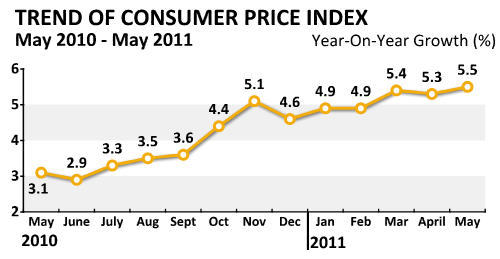

CPI up 5.5% China's consumer price index (CPI), the main gauge of inflation, rose 5.5 percent year-on-year in May, the highest rate in 34 months. CPI rose 5.2 percent year-on-year in the first five months of the year, NBS spokesman Sheng Laiyun said. Food prices, which account for nearly a third of the basket of goods in the nation's CPI calculation, surged 11.7 percent in May from a year earlier. [Full story] |

||||||||||

|

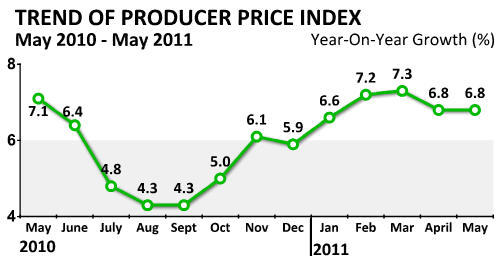

PPI up 6.8% China's producer price index (PPI), a major measure of inflation at the wholesale level, rose 6.8 percent in May year-on-year. The world's second largest economy "is still facing significant inflationary pressure," which will persist for a while, and the government must attach great importance to the issue, NBS spokesman Sheng Laiyun said. [Full story] |

|||||||||||

|

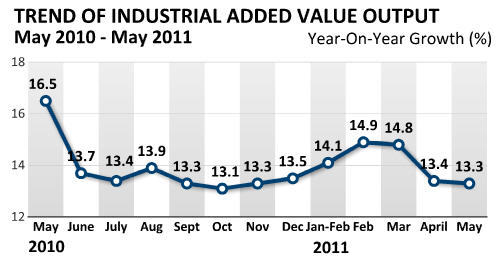

Industrial value-added output up 13.3% China's industrial value-added output grew 13.3 percent year-on-year in May this year. The year-on-year industrial value-added output growth in May was 0.1 percentage point lower than that in April, according to the NBS. The May data took the industrial value-added output growth in the first five months of this year to 14 percent, down 0.2 percentage point from the January-April period, NBS spokesman Sheng Laiyun said. [Full story] |

||||||||||

|

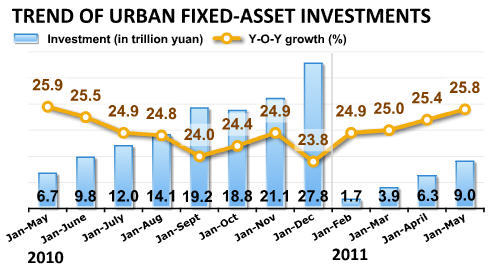

Fixed asset investment up 25.8% in Jan-May China's fixed asset investment rose to 9.03 trillion yuan in the first five months, up 25.8 percent from the same period last year. In May, fixed asset investment rose 1.02 percent from April. During the first five months, investment in the nation's property sector rose 34.6 percent year-on-year to reach 1.87 trillion yuan -- of which 1.33 trillion yuan went into residential housing, an increase of 37.8 percent from the same period last year. [Full story] |

||||||||||

|

Retail sales up 16.9% China's retail sales of consumer goods rose 16.9 percent year-on-year to 1.47 trillion yuan ($226.77 billion) in May this year. The reading was 0.2 percentage points lower than April's, according to figures released by the National Bureau of Statistics (NBS). In May, the country's retail sales totaled 1.47 trillion yuan ($226.77 billion), 1.28 percent higher than in April, said the NBS. [Full story] |

||||||||||

|

PMI of manufacturing sector declines The Purchasing Managers Index (PMI) of China's manufacturing sector dropped to 52 percent in May, the China Federation of Logistics and Purchasing (CFLP) said Wednesday. The PMI figure was 52.9 percent in April, 53.4 percent in March, 52.2 percent in February and 52.9 percent in January. [Full story] |

||||||||||

|

Trade surplus rises to $13.1b China's trade surplus climbed to $13.05 billion in May from $11.43 billion in April, the General Administration of Customs said on Friday. Exports rose 19.4 percent from a year ago to $157.16 billion and imports jumped 28.4 percent to $144.11 billion. [Full story] |

||||||||||

|

|

New lending shrinks to 551.6b yuan China's new bank lending, an important indicator of the monetary policy, shrank to 551.6 billion yuan ($84.86 billion) in May from April's 739.6 billion yuan. The figure was also 100.5 billion yuan less than that of last May. [Full story] |

||||||||||

|

Fiscal revenue rises 34% Chinese Ministry of Finance said on Friday that the country's fiscal revenue rose 34 percent year-on-year to 1.061 trillion yuan ($163.6 billion) in May. [Full story] |

||||||||||

|

|

FDI rises 13.4% The Ministry of Commerce (MOC) said Wednesday that foreign direct investment (FDI) in the country rose 13.43 percent year-on-year in May to $9.225 billion. The growth rate slowed from an increase of 15.21 percent for April when FDI stood at $8.46 billion. [Full story] |

||||||||||

| Comments & Opinions | |||||||||||

|

Mid-year slowdown needed Less speedy manufacturing growth is the latest sign that China may be entering a new phrase in its hard fight against soaring inflation. Chinese policymakers should make it clear that they are ready to endure a period of moderate growth long enough for a decisive change in inflationary expectations to take root in this country. [Full story] |

|||||||||||

|

Crucial period for economy The uncertain external environment and dwindling external demand, together with all-inclusive macroeconomic policy regulation, have directly resulted in an economic decelerating in the world's second largest economy. To smoothly push forward long-overdue economic restructuring and survive the period of transition, some sweeping and systematic reforms are badly needed to bring the world's second largest economy onto a normal and sustainable track.[Full story] |

|||||||||||

|

Strategies of innovation Whether or not China can realize its ambitious strategy of developing itself into an innovative and creative nation will be decided to a large extent by whether it can boost the competitiveness of its homegrown technologies, its cultural power and the influence of domestic brands. To facilitate this process, the country needs to take more concrete and effective measures to strengthen protection of its intellectual property rights (IPR) and innovation. [Full story] |

|||||||||||

|

Export engine hums along A trade surplus of $13.1 billion in May can be interpreted as evidence of the cup being half full or half empty. It is higher than that in April and shows that Chinese exporters are faring well. But it is less than expected, underlining a pullback in global demand that bodes ill for export growth. Exercising caution against reading too much into the data, which could change wildly from month to month, we believe that the world's second largest economy has kept its export engine humming and that is a good cause for optimism. [Full story] |

|||||||||||

|

People first, not GDP For ordinary Chinese people, GDP was something linked to the building of skyscrapers complex and new roads. Many ordinary Chinese people, especially those low-income households, have come to realize that the country's double-digit GDP growth over the past decades has not substantially raised their living standards. On the contrary, for some of them their living standard has declined. The lack of an accompanying increase in labor remuneration to match productivity over the past decades has become a top social issue in today's China. Its solution lies in effectively raising ordinary people's incomes and providing them with the means to share the country's economic fruits. [Full story] |

|||||||||||

|

|

|||||||||||