Pictures

Smart grid project generates local buzz

By Liu Yiyu (China Daily)

Updated: 2010-06-10 10:45

|

Large Medium Small |

Some State-owned companies also showed an interest in the smart-meter market. China Aerospace Science & Industry Corp, the country's space and defense manufacturer, has acquired two-meter makers, Shenzhen-based Techrise Electronics and Xi'an-based Liangli Instrument.

|

|

Pharmaceutical companies are also eying various market entry vehicles. Holley Pharm Co is splitting its pharmaceutical assets and plans to focus on instruments and equipment related to smart grid.

Realizing the market potential, State Grid said it also hopes to get a foothold in the equipment business. It moved into the upstream business by acquiring electrical-equipment makers Pinggao Electric and XJ Electric early this year.

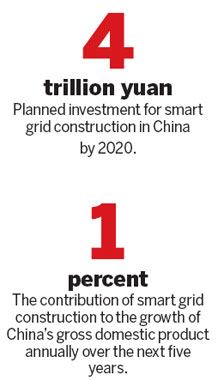

"China's 4 trillion yuan investment in the smart grid sector will quickly stimulate demand for smart meters and the development of digital substations," said Li Shengmao, an industry analyst with China Investment Consulting.

Nari Technology Development, a listed unit of State Grid, is a high-tech enterprise specializing in power-systems management. Nari which boasts a 40 percent market share in substation automation - an automated monitoring system that maintains uninterrupted power services - is likely to be the largest beneficiary as the market for products and systems related to the automated monitoring will reach 8 billion yuan in five years based on the State Grid's construction plan.

|

||||

Chinese equipment makers plan to put up a fight for the smart-grid market. Zhan Xi, executive vice-president of Guodian Nanjing Automation Co, a Shanghai-listed equipment maker, said local companies understand domestic market conditions better than their foreign counterparts.

He also said that some Western smart-grid models are based on local power plants distribution power within a community and thus don't fit China's model of exporting electricity to cities far away.