Marketing crucial as sales cool

By Jenny Gu (China Daily) Updated: 2012-05-21 07:48Experience the key in April as the strong got stronger

Stronger growth in light vehicles sales in April was no great surprise, but concerns remain about the overall market weakness in the first four months of 2012.

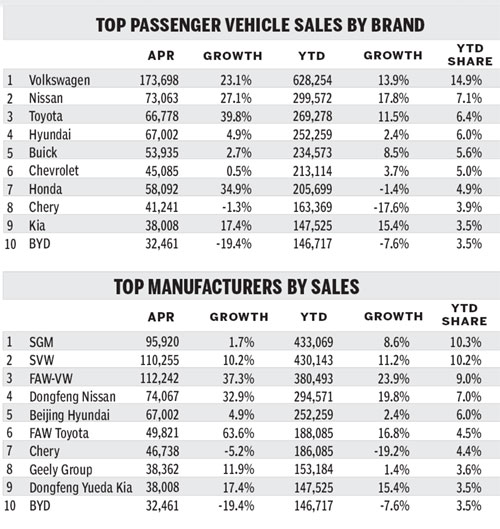

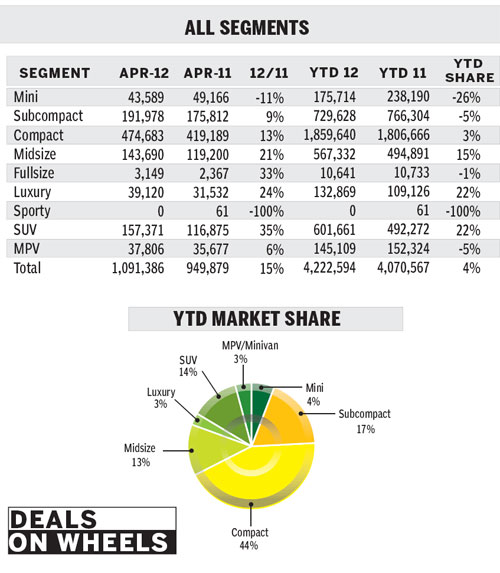

Passenger vehicle sales totaled 1.2 million units, returning to double-digit growth of 18 percent. Sales of locally built models increased 15 percent year-on-year, while import models grew 60 percent, as was our estimate.

In contrast, the light commercial vehicle segment had much weaker performance. Total sales in April were 434,000 units, down 2 percent from the same month last year.

Our seasonal adjusted projection for full-year 2012 sales now stands at 18.6 million units on the heels of those April numbers, up 2 percent from the 18.3 million-unit projection in March.

The April-adjusted rate for passenger vehicles was 14 million units, 2.4 percent higher than the average rate in the past five months.

But the projection for light commercial vehicles was 4.6 million units, 9 percent lower than the average rate over the past four months.

Losing market share

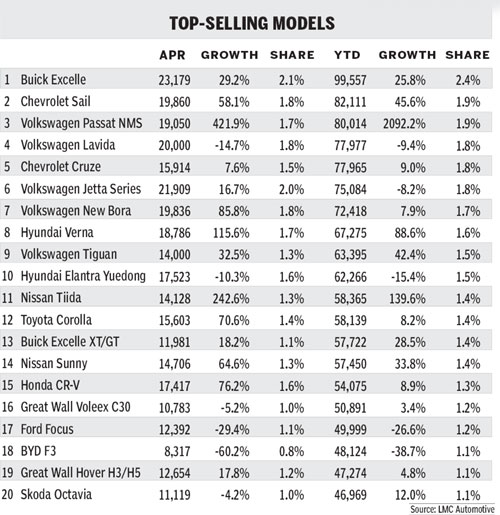

The segment performance showed a similar pattern to the first quarter. Small and compact car segments continued to lose overall market share while midsize cars, SUVs and luxury cars were the main drivers of growth.

The SUV share of the passenger vehicle market in April rose to 18 percent compared to 16 percent by the end of 2011.

Automaker performances in the weakening market showed a strong "Matthew effect", the social phenomenon in which "the rich get richer and the poor get poorer".

In the first four months, the top five sales groups - Volkswagen, GM, Hyundai-Kia, Renault-Nissan and Toyota - continued to show their dominance as their combined market share rose from 47.9 percent at the beginning of the year to 52.2 percent by the end of April. VW, GM and Renault-Nissan were the biggest winners.

In contrast, Honda, Chery, Geely, BYD and PSA, which rank sixth to tenth in sales, lost 2.1 percent of the passenger vehicle market in the period.

Part of the reason the strong get stronger is their advanced tracking systems that can provide flexible and scalable marketing methods to meet various customer requirements.

We have learned that Shanghai GM has begun using regional marketing techniques that give sales teams in various provinces the flexibility to provide different incentives or promotions.

Online results

Dongfeng Nissan has established an online marketing department that attracted a million potential buyers using the Internet, and succeeded turning 10 percent of them into final buyers.

In contrast, some automakers still follow the old way of marketing by setting up more dealers, selling more vehicles to wholesale dealers or cutting prices with limited fine tuning.

One local brand, Great Wall, managed to rapidly gain market share from 2009 to 2011 with its Voleex sedan.

One reason for the success was the right timing for the product launch, which came as the company's main competitors such as the BYD F3, entered the end phase of their lifecycles. In addition, reasonable positioning for the product also helped Great Wall to attract customers.

As the market becomes increasingly fragmented, dynamic marketing to meet varied conditions is essential to gaining share.

Marketing is the only channel for potential customers to learn about the products before they decide to buy.

Mature markets need a basket of marketing approaches by each manufacturer that offers the most appropriate answer to particular market conditions.

But this requires long-term accumulation of knowledge and experience, a weakness at most domestic automakers.

The author is a senior analyst at LMC Automotive. She can be reached at JGu@LMC-auto.com

- National projects aimed to help revive China's rust belt

- Leading Chinese shipbuilder profits slump in first half year

- Top 10 Chinese private enterprises in 2016

- Scenery of West Lake in E China's Zhejiang

- China to build 40 manufacturing innovation centers by 2025

- Stock connect to start in November

- EU demands Apple pays Ireland

- Xiaomi battles rival on mobile payments