Year-to-date sales strong despite May slowdown

By Ryan Cui (China Daily) Updated: 2013-06-24 07:41

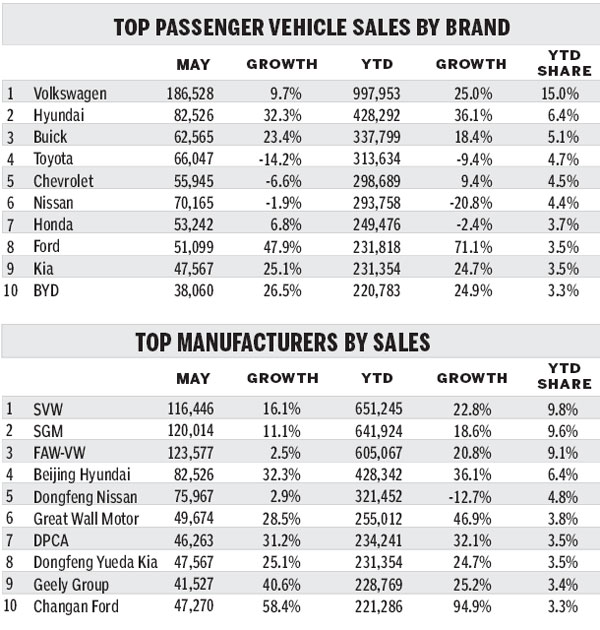

After unexpectedly strong growth in the first four months of 2013, light vehicle sales in May finally slowed down as we predicted.

A total of 1.73 million light vehicles were sold, up 8 percent year-on-year.

Light commercial vehicle sales remained disappointing, with only 1 percent increase year-on-year to 0.42 million units.

Passenger vehicle sales performed much weaker than in the four months previous, with a 10.5 percent increase year-on-year to 1.3 million units.

The annual projection of light vehicle sales based on figures in May dropped to the lowest level of the year. It only reached 20.75 million units, down 5.8 percent from the previous month.

The annual projection for passenger vehicles declined to 16.01 million units, while that for light commercial vehicles dropped to 4.74 million units.

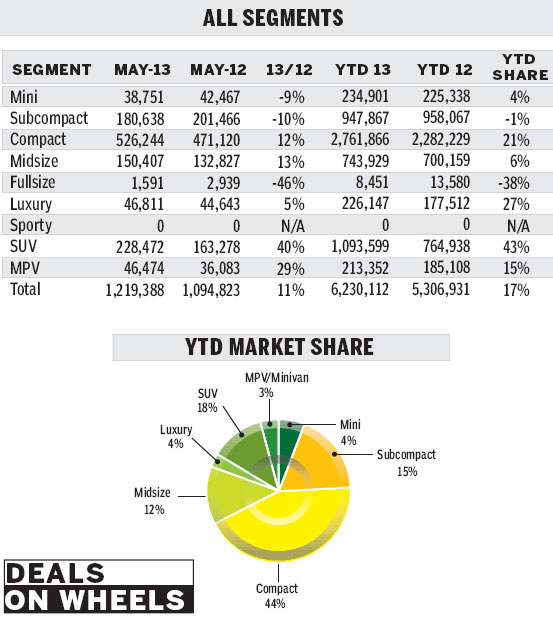

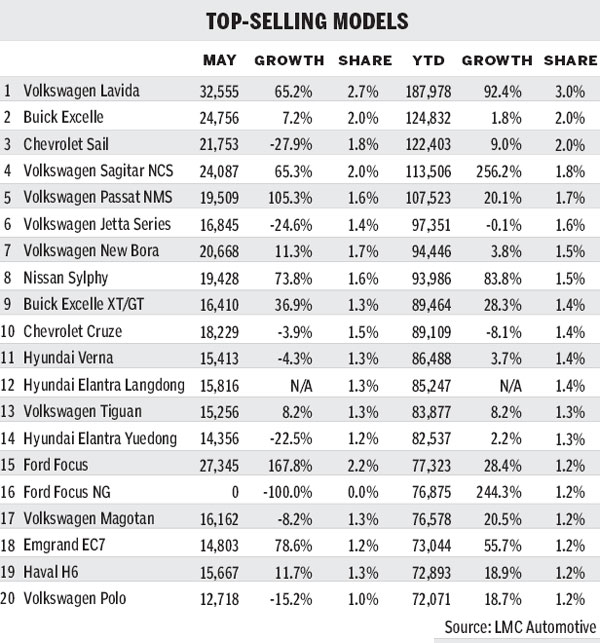

Similar to April, growth in May was mainly bolstered by the normalized sales of compact cars and mid-size cars and also by the booming sales of several newly launched SUVs.

SUV sales surged by 30 percent year-on-year to 0.21 million units, accounting for 17 percent of total passenger vehicle sales.

The subcompact car segment continued to be a weak contributor to overall market performance. Sales in this segment slumped more than 10 percent year-on-year due to the lack of new models and lost ground to compact cars, which recently underwent a round of price cuts.

Though passenger vehicle sales were lackluster overall in May, year-to-date sales remained strong, with a 17 percent increase year-on-year, which is higher than our previous forecast. That's why we revised our short-term forecast for passenger vehicles in April.

But as we mentioned in the executive summary in March, some clues had hinted at a slowdown in passenger vehicle sales in the second quarter relative to the rapid acceleration seen in the first. It started to be reflected in the sales in May. We believe that the risks of a slowdown in sales growth will continue to accumulate.

First, according to China Automobile Dealers Association, the vehicle inventory alert index remained higher than alert level in May.

As June and July are traditionally low seasons in vehicle sales, the vehicle inventory alert index will continue to rise, and the overall sales growth rate will decline.

Second, the growth of total exported vehicle value was much lower than the export volume growth, reflecting a significant decline in profit. Moreover, in May, even the vehicle export volume saw a year-on-year decline for the first time since 2008. The share held by Chinese carmakers in Russian and Brazilian markets also slumped.

Third, the global upturn is less robust than we expected. GDP growth in China slowed down. The HSBC manufacturing purchasing managers' index for May dropped to a seven-month low, suggesting that the weakness has persisted in the second and third quarter. Oxford Economics reduced their forecast on GDP growth for China in 2013 from 7.9 percent to 7.5 percent.

Finally, because of the serious air pollution in some regions, greater car restrictions will likely be implemented in some second-tier or third-tier cities in the future, potentially hurting car sales in these growth markets.

To conclude, though there are many negative factors to consider, we have retained our short-term sales forecast for 2013 passenger vehicles at 16.07 million units, up 12.8 percent.

The light commercial vehicle market sales forecast remains at 5.3 million units, or 6.2 percent. We also kept our long-term forecast for light vehicles.

The writer is a market analyst at LMC Automotive and can be contacted at Xcui@lmc-auto.com

- China to reform state assets management system

- Modernization has paid off for the coal industry

- Lipsticks with a rainbow of rare earths

- Food for thought for Russian entrepreneur

- New mega medical imaging plant rises

- Chinese firms ascend global rankings

- 'Credit cities' make inroads in China

- Outbound M&A bounces back in Q2