April's sales slowdown signals further challenges

By Zhu Bin (chinadaily.com.cn) Updated: 2015-05-28 17:30

|

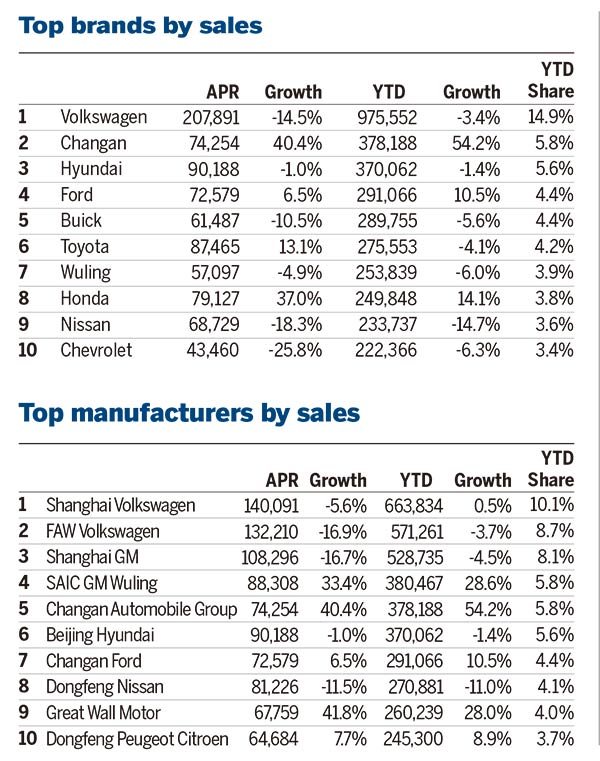

In response to Shanghai Volkswagen's recent adjustment to the manufacturer's suggested retail price of both the Polo and the Touran, Shanghai GM — another major player in China's passenger vehicle market — has followed suit by slashing the MSRP of around 40 of its models.

Undoubtedly, these cuts will have contributed to the prevailing tone of the current market; after all, such adjustments are rare and differ from promotions in that they are permanent reductions in price, which cannot be recouped once the market has recovered.

More pertinently, however, these efforts are likely to have only a limited impact on overall sales since it is the showroom prices that really matter, and these have been reduced to their lowest possible levels already.

Having posted year-on-year growth of more than 20 percent in Q1, combined sales of Chinese-branded passenger vehicles and mini buses also showed signs of deceleration, with yearly sales growth of vehicles in the category dropping to 15 percent in April.

Buoyed by surging sales of low-priced SUVs, however, we believe that Chinese brands will continue to enjoy faster growth than the market average, although their higher inventory levels may pose a risk to future market expansion.

In contrast to the destocking that has been taking place at dealer level, expanding inventories at the original equipment manufacturer level beg the question as to whether more radical revisions to production rates might be required over the next three to six months.

In the last twelve months, the disparity between output and wholesales of passenger vehicles has extended to 360,000 units, equivalent to nearly 2 percent of total production in the period, and far in excess of the average of 0.5 percent in the Chinese market in the recent past.

When viewed as a whole, these factors point unequivocally to a slowdown in market growth, and the end is not yet in sight.

Ultimately, the industry will have no choice but to brace itself for some turbulent weather ahead, just as the summer months are approaching.

The author is China forecasting manager at LMC Automotive. Contact the writer at bzhu@lmc-auto.com.

- Chinese online shop a choice for more Brazilians

- China treasury bond futures open mixed Monday

- China stocks open higher Monday

- China nuclear power firms merge to fuel global clout

- China's non-manufacturing PMI continues dipping in May

- China manufacturing activity continues to improve in May

- Helping aged also helps the economy

- Beware of capital account liberalization