Auto experts warn of looming overcapacity Dangers

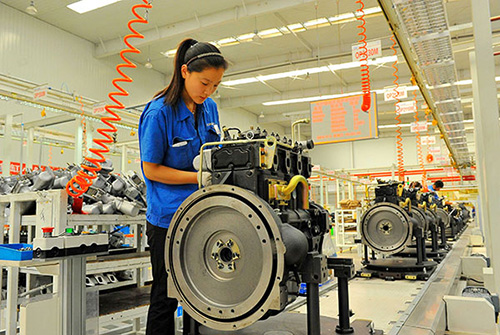

By Li Fusheng (China Daily) Updated: 2016-05-16 14:31According to a recent survey of 37 automakers in China, many commercial vehicles are not being sold

Experts are warning of structural overcapacity in China's automotive industry after a survey released on Wednesday showed that 37 automakers in China had a combined capacity of 31.22 million cars by the end of 2015.

The survey shows automakers had 25.75 million units of passenger cars, 5.47 million units of commercial vehicles, and will be adding another 6 million units annually through its production facilities.

Eighty percent of the passenger car capacity were utilized, a reasonable level, but nearly 49 percent of the commercial vehicle capacity went idle in 2015, said Huang Yonghe, an official at the China Automotive Technology and Research Center.

The survey was done by the center, the China Association of Automobile Manufacturers and the National Development and Reform Commission.

With China's auto industry slowing, experts are urging automakers to be cautious about expanding their capacity, especially commercial automakers.

China sold 343,000 commercial vehicles in April, a 5.4 percent growth year-on-year, lower than the overall auto growth rate of 6.3 percent, according to the China Association of Automobile Manufacturers.

The larger picture is even more disheartening: 1.2 million commercial vehicles were sold through the first four months this year, a mere 2.7 percent increase year-on-year.

Another segment that is prone to overcapacity is the new-energy vehicles, according to the survey, though sales of new-energy cars have been strong. Sales of NEVs reached 31,772 units in April, a 190 percent rise year-on-year, according to CAAM statistics.

A total of 90,529 new-energy vehicles were sold through the first four months of the year, a 131 percent surge from the same period last year.

But the survey shows that companies producing key components of new-energy vehicles can basically meet market demand.

By the end of 2015, 19 battery makers could deliver 30.5 million kilowatt-hour, 12 major companies could roll out 700,000 electric motors a year and 680,000 controllers a year.

That should sound a warning to automakers, especially new ones to the industry, and local governments who have been enthusiastic about attracting investment, said experts.

They encouraged better usage of existing capacity by partnering with large automakers, like NextEV's 10 billion yuan ($1.54 billion) deal with JAC earlier last month to produce smart and electric cars.

Xu Heyi, chairman of BAIC Group, said the automaker is willing to work with new forces in the industry at a forum earlier this year.

Experts say traditional automakers will be more and more willing to better utilize their capacity now that auto sales in the country are slowing down.

In line with expectations

Statistics show that 8.65 million cars were sold in the first four months, a 6.1 percent growth from the same period last year.

Shi Jianhua, CAAM's vice-secretary-general, said the growth over the first four months of the year is consistent with the association's estimate of about 6 percent, which would translate into 26 million vehicles sold.

SUVs have kept their momentum. Nearly 610,000 SUVs were sold in April, a 31.6 percent surge year-on-year, the highest of all segments in the Chinese auto market.

Three of the five most popular SUVs, according to the China Passenger Car Association, are from Chinese manufacturers: the H6 and H2 from Haval and the CS75 from Changan.

Sales of MPVs are healthy , with nearly 180,000 units sold in April, a 7.49 percent rise year-on-year. Sales of sedans and crossovers were not as strong. In April, 900,000 million sedans were sold, a 2.91 percent fall year-on-year. Crossovers saw their sales in April slump more than 20 percent year-on-year to 85,000 units.

China's favorable policy on small-engine cars is still going strong, with 1.28 million cars with engines at or below 1.6 liters sold in April.

That accounts for 71.9 percent of passenger vehicles sold in the month, a similar percentage to that of the previous three months.

Chinese passenger car brands saw their market share edge 1.4 percentage points to 42 percent in April, the lowest point this year.

- China's Huawei steps up cooperation with UK trade agency

- China cuts its holding of US treasuries in March

- Chinese banks' forex sales narrow in April

- The coming caffeine rush expected in China

- HNA Group may buy stake in Singapore logistics firm

- Didi said to be mulling New York IPO

- Starbucks pulls off China's face-changing stunt

- Leading office-sharing company UR Work goes for IPO