Problems still beset Peugeot and Citroen

|

|

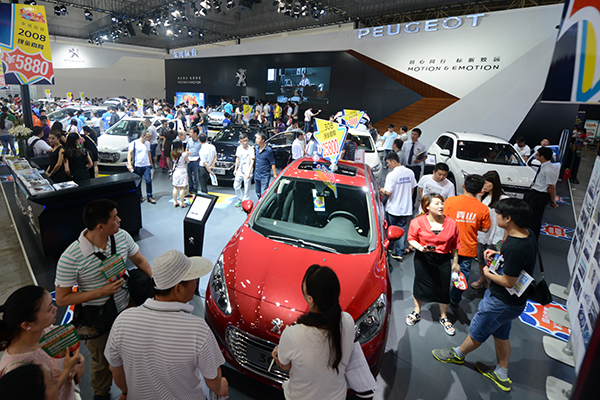

Cars produced by Dongfeng Peugeot Citroen Automobile Co catch visitors' eyes at an auto expo in Wuhan, Hubei province. [Kun Shao/for China Daily] |

The automaker has to differentiate the two French brands from one another, and better met local needs if it is to succeed in the competitive Chinese market

Peugeot and Citroen still have to better position their portfolios and balance their operations if they are to address their declining sales, according to industry experts.

Dongfeng Peugeot-Citroen Automobile Co, PSA Group's Chinese venture, lowered its annual target after sales of Peugeot and Citroen vehicles have been on the wane in the past half year.

The joint venture set an ambitious goal of 700,000 units at the beginning of the year. But the sales volume of Peugeot tumbled 36.7 percent to 102,199 units in the first half of the year and Citroen's sales dropped 63.2 percent to 45,630 units.

The Wuhan-based automaker claimed the recent sales volume is more than these figures, as the majority of the deliveries are vehicles from stock rather than newly produced cars.

The industrial statistics system calculates only the newly produced and sold cars. The Peugeot and Citroen stock vehicles have already been registered last year, despite they are sold to dealers rather than the end users.

"We have many more deliveries not registered in the statistics. The actual monthly delivery volume to the end user is about 10,000 units larger," Zhou Liqin, media manager at DPCA, told China Daily.

Liu Weidong, chairman of the board of DPCA at that time, announced in March this year that the company had adjusted their business model to help dealers move their stock accumulated in 2016, so the deliveries weigh heavier internally than new car sales in an aim to boost the profitability of the dealers.

PSA values profitability more, but the Chinese executives from Dongfeng Motor are eyeing the sales volume, according to an industry insider who declined to be named.

This conflict has apparently existed within the Sino-French joint venture for quite some time, despite Dongfeng Motor being one of the two largest shareholders of PSA.

Besides the weakness in internal management as shown by the executive shuffles, the critical issue for DPCA is line-up, sources said in anonymity.

"Chinese customers are not buying PSA's romantic designs as they fail to meet the needs of Chinese consumers," said the sources.

The original exterior and interior designs, directly applied to the local products, are expected to convey the sense of a Gallic lifestyle to Chinese customers, who are more used to the more functional designs of German and US brands.

John Zeng, managing director at consultancy LMC Automotive Shanghai, said: "It's not easy for the Chinese consumers to accept the unique layouts and many of the details in Peugeot and Citroen cars."

Recognition

The locally produced Peugeot and Citroen models are priced similarly to their German peers, which are viewed as better brands, rather than priced to compete with Japanese and South Korean brands.

"DPCA should consider the reason why they have such a limited market presence. Their market recognition is not strong enough to support their price." said Zeng.

He said because of this, Peugeot and Citroen are suffering due the market trend in which premium brands are launching smaller cars at lower prices while the prices of local brands are riding.

"Some of the younger Chinese consumers are after better quality; some recognize brands that are good value for money. But Peugeot and Citroen are not among them. The time left for the two brands to turn it around is decreasing," Zeng noted.

Another factor dragging down the two brands are their slow pace in bringing their latest offerings to the world's largest market, where the customers are eager for the latest products.

Sources said: "Almost all the international automakers give priority to China and put the country among the first batch to witness the latest models.

The German brands, including the BMW and Mercedes-Benz, have been doing so for years."

And not only are Peugeot and Citroen not agile enough in launching their latest offerings, they have had different generations of a model available at the same time in the past several years.

Sources said such behavior has been detrimental to the image of the two brands as a result "Peugeot and Citroen cars depreciate in value much faster than the other European brands."

Positioning

Peugeot and Citroen's differentiation in the Chinese market is subtle. DPCA are trying to position Peugeot as a premium brand and Citroen as a value for money brand. However, DPCA is offering the top Citroen model, the C6 at a manufacturer suggested retail price ranging from 189,900 to 279,900 yuan ($28,510 to $42,030).

And the mid-size sedan launched last year had the most expensive manufacturer suggested retail price among DPCA's lineups so far.

The economy brand should be priced 20 to 30 percent less than the premium one to form a brand ladder, otherwise customers won't receive the message about their position, according to Zeng.

Take the Citroen C6 as an example, the manufacturer's suggested retail price needs to be slashed by least 20 percent, Zeng said, meaning a discount of 37,980 to 55,980 yuan, not to mention the dealer's discount at the point of purchase.

"To boost one of the two brands to a premium level, the other has to bear the sacrifice," said Zeng.

He's bullish about Renault's development in China as it shares Dongfeng Nissan's production facilities. The Dongfeng-Renault-Nissan partnership produces budget choices carrying the Nissan badge, while Renault takes the higher segment with more comfort and technology configurations. Renault and Nissan have synchronizing effects from sharing the manufacturing platforms, but do not cross sell to customers, according to Carlos Ghosn, president and CEO of Renault-Nissan Alliance, in an earlier interview. He said those customers who are considering a Renault model will not compare it with a Nissan model, so the lower-priced Nissan faces no threat from the better configured Renault.