Market growth slows, but momentum to continue

|

|

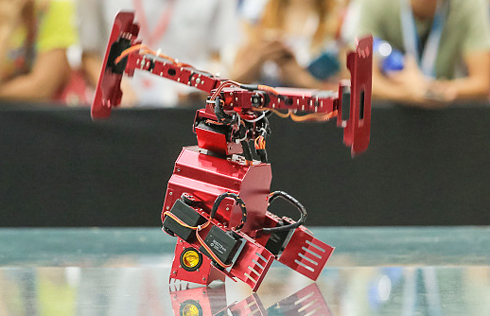

A BYD Qin electric car catches visitors' eyes at an international auto show in Wuhan, Hubei province. [Photo/Xinhua] |

Analysts say late-2016 surge can't be matched, but industry still expanding at good pace

China saw a nine-month high for car sales in September, with 2.7 million cars delivered in the month, according to the country's leading industry association.

The China Association of Automobile Manufacturers expects an annual growth rate of around 4 percent.

Sales in September were up 5.7 percent year-on-year, according to statistics the CAAM released last week.

This brought sales in the first nine months of the year to 20.22 million vehicles, marking 4.5 percent growth year-on-year. However, the figure is 8.7 percentage points lower than in the same period last year.

The CAAM predicted that sales momentum will continue into the fourth quarter. But it said that the growth rate could slow because of the sales peak in late 2016, resulting from millions of customers rushing to buy before a favorable purchase tax drew to a close.

Introduced in late 2015, the policy aimed to boost car sales by halving the purchase tax on cars with engines at or below 1.6 liters.

"Under such circumstances, it would be rather difficult to reach our estimate of 5 percent for the year, but it is very likely to fall between 4 to 5 percent," said Shi Jianhua, the association's deputy secretary-general.

"We were used to high-speed growth, but if you look around the world, you will see the current growth rate is still a decent one."

Shi said he believes that a relatively low growth rate is favorable for the development of the industry as a whole.

"When the market grows quickly, carmakers are preoccupied with selling more cars to make more money. But when it slows, they are more likely to consider how to build more competitive products."

Passenger cars

Sales of passenger cars - which accounted for the absolute majority of car sales in the country - stood at 2.34 million vehicles in September, posting growth of 3.3 percent.

In the first nine months of the year, passenger car sales totaled 17.15 million, 2.4 percent growth year-on-year.

Even this meager growth was impossible without soaring SUV sales, a sector which has seen continued growth for years.

Statistics from the CAAM show that from January to September, 6.96 million SUVs were sold, a 16.1 percent rise year-on-year.

All other segments, including sedans, multipurpose vehicles and minivans, saw sales drop, with falls ranging from 1.45 percent to 25.5 percent.

But commercial cars, especially trucks, are another story altogether because of China's infrastructure drive, said Chen Shihua, an assistant to the CAAM's secretary-general.

Nearly 370,000 commercial cars were sold in September, a 24 percent surge year-on-year. From January to September, sales reached 3.07 million vehicles, 17.9 percent growth from the same period last year, much higher than the car industry's average growth rate of 4.5 percent.

New energy cars are the fastest-growing segment so far. Some 78,000 such vehicles were sold in September, a 79 percent surge year-on-year and a nine-month high. Of them, electric cars are growing the fastest, with sales surging 83.4 percent to 64,000 in September.

From January to September, 398,000 new energy cars were sold, up 37.7 percent year-on-year. The CAAM estimated new energy car sales could hit 700,000 vehicles this year. Last year, 500,000 such cars were delivered in China.

Xu Haidong, an assistant to the organization's secretary-general, said the target growth is within reach because sales usually rise in the latter half of the year, a pattern that has been seen in the past two years.

Analysts believe new energy cars will soon seize a larger share of the car industry, especially in China. The country has released a policy that carmakers must produce a certain number of new energy cars for the Chinese market starting from 2019.

Several international carmakers, including Volkswagen and Nissan, are establishing joint ventures in China dedicated to such cars. Many others have announced plans to introduce new energy vehicles into China, which has been the world's largest market for such cars since 2015.