Online finance now 'due for consolidation'

By Zheng Yangpeng (China Daily) Updated: 2014-04-08 07:25

|

|

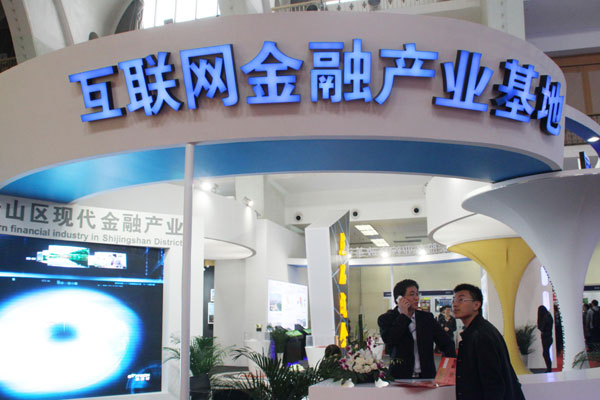

Internet finance companies at an international finance expo in Beijing. China's online finance businesses are providing more funding channels for small and medium-sized enterprises. But the way for them to survive, experts said, is differentiation, which means finding specific niche markets in a vast business population. Wu Changqing / For China Daily |

The emergence of Internet finance in China is providing more funding channels for small and medium-sized enterprises, but that's not necessarily good news for all lenders in the domain.

Emmanouil Schizas, senior economic analyst of the Association of Chartered Certified Accountants, an international professional organization, said major consolidation might be on the way for China's vigorous Internet finance sector, which has by his count "tens of thousands" of small companies.

|

|

|

Time to show more online interest

|

The way to survive, he said, is real differentiation, which means finding specific niche markets in a vast business population.

"The test for survival is whether they do anything different in terms of the four raw materials of business financing: information, control, collateral and risk appetites," said Schizas, who is also acting head of the ACCA's small business policy team based in London.

For example, if a platform makes it substantially easier and cheaper for investors to create a diversified portfolio, that's adding value. Some P2P lending firms give the option of automatic bidding on loans, but very few give investors any diagnosis of how interrelated the different positions are, so that they know how much "real diversification" they get, he said.

"The Internet service sector is really concentrated. What comes to mind when you think of online shopping (in the West)? It is Amazon, Amazon and Amazon. That's it," he said.

|

|

- TV Debate in Boao Forum for Asia Annual Conference

- White swans seen on Ulunggur Lake, Xinjiang

- China auto sales rise 9% in March

- End of Windows XP helps open doors to outsiders

- Nokia sale of unit to Microsoft approved

- China tops in online shopping

- Top 10 economies where women call the shots

- More Chinese small firms to enjoy tax breaks