JD.com prices up IPO to raise $1.78b on Nasdaq debut

By Meng Jing (China Daily) Updated: 2014-05-23 07:02China's business-to-consumer e-commerce sales may surpass $180 billion this year due to rising Internet usage, expanding middle-class incomes and a better distribution network, according to New York-based market research firm eMarketer.

|

|

|

|

The selling shareholders, including CEO Liu, Tiger Global Management, Hillhouse Capital Management, DST Global funds and Capital Today, would pocket $468 million.

Formerly known as 360Buy, JD.com has already raised more than $2 billion in previous years from investors.

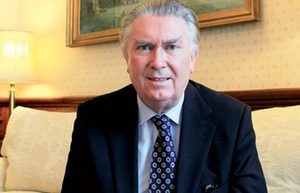

Despite the fact that Chinese e-commerce players are expected to become increasingly competitive, especially with the money they raise in the US market, Brian Hui, vice-president of Amazon China, was happy to see more of that company's Chinese counterparts going public.

In a recent interview with China Daily, Hui said that China's e-commerce market is becoming "healthier and healthier", with almost all of its major players planning IPOs this year.

"Being a listed company means that you need to follow certain rules in terms of the financial operation and management," he said, adding that the e-commerce market in China is entering a new stage, with more companies following the same code of conduct.

Agencies contributed to this story.

- Direct air route links Tianjin, Russia's Moscow

- China to add R&D spending in GDP

- Xiaomi sees 271% rise in smartphones sales

- Craiglist-like Ganji transfers business to Tianjin

- More economic interactions needed in China-Russia relations

- US Lew urges China to appreciate yuan, open investment market

- LG Chem signs MOU to build China EV battery plant

- China Eastern turns Beijing unit into budget carrier