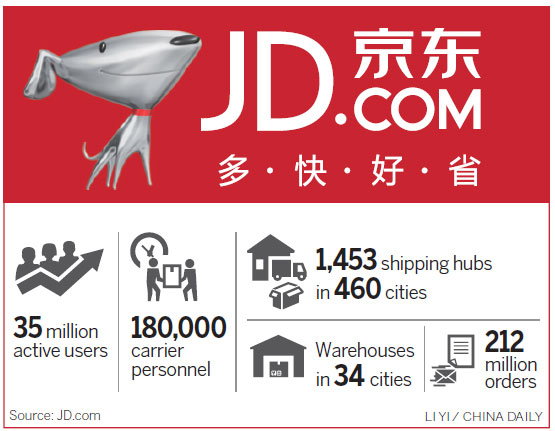

JD delivers with 10% increase on Nasdaq debut

By He Wei in Shanghai (China Daily) Updated: 2014-05-24 07:27

A new wave of enthusiasm for Chinese companies swept Wall Street as e-commerce giant JD.com Inc made its Nasdaq debut on Thursday.

Shares of the Chinese online retailer closed at $20.90 on the first day, 10 percent higher than the offering price, igniting hopes that tech stocks, along with China concept shares, are on the mend.

The company's initial pricing topped the expected range of $16 to $18 per share.

|

|

The lack of profitability of JD.com didn't seem to deter investors, said Hong Bo, founder of IT portal IT5G.

Earlier this week, JD.com reported a first-quarter net loss of 3.795 billion yuan ($608.4 million), in contrast to a year-earlier profit of 13 million yuan. Some analysts speculated that figure would affect its IPO performance.

Investors shrugged off the news, giving more weight to growth potential than short-term financial performance, Hong said.

The retailer's business model resembles that of Amazon.com Inc, which has proven to be successful and sustainable in the United States market, said Lin Wenbin, analyst at research firm Analysys International.

"Tantalizing" sales prospects helped JD double its valuation from the goal set in its prospectus last December, said Wang Liyang, a veteran technology commentator.

"Partnering with Internet giant Tencent Holdings Ltd" helped inspire investors to imagine a bright future for the company, Wang said.

JD's inflated capitalization may boost the valuation of rival Alibaba Group Holding Ltd, which filed for an IPO in March. Alibaba's market value is projected to top $150 billion.

- Direct air route links Tianjin, Russia's Moscow

- China to add R&D spending in GDP

- Xiaomi sees 271% rise in smartphones sales

- Craiglist-like Ganji transfers business to Tianjin

- More economic interactions needed in China-Russia relations

- US Lew urges China to appreciate yuan, open investment market

- LG Chem signs MOU to build China EV battery plant

- China Eastern turns Beijing unit into budget carrier