Tencent slumps after Ma cuts stake: report

By Yu Xiaoming (chinadaily.com.cn) Updated: 2015-04-14 14:06

|

|

|

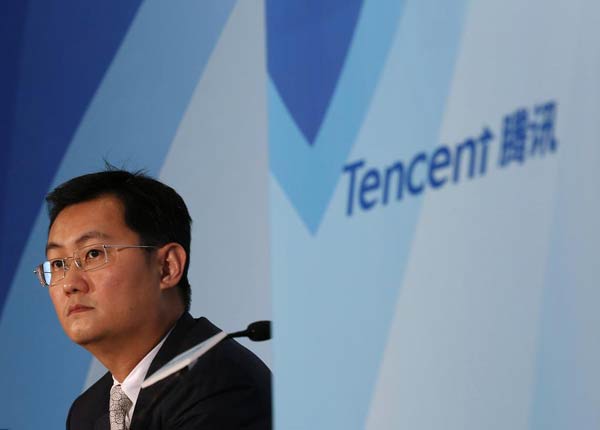

Tencent Chairman & Chief Executive Officer Pony Ma Huating attends a news conference announcing the company's results in Hong Kong March 18, 2015. [Photo/Agencies] |

Tencent shares saw the largest drop in a year at the trading break in Hong Kong, after chairman Pony Ma Huateng cut his stake in China's biggest social networking and online entertainment firm, according to a Bloomberg report.

Chairman Ma Huateng, China's third-richest person, cut his stake to 9.65 percent from 9.86 percent and raised a combined HK$3.22 billion ($415 million), according to filings to the Hong Kong stock exchange Monday.

Tencent slumped for the first time in 10 days, and the stock fell 4.4 percent to HK$163 at the trading break in Hong Kong, the most in almost a year. The benchmark Hang Seng index declined 0.5 percent.

Selling shares sent a signal to investors to withdraw from the stock after a 62 percent surge in the 12 months through Monday, the report quoted Louis Tse, a Hong Kong-based director of VC Brokerage Ltd, as saying.

Tencent rose 5.38 percent to close at HK$170.50 in trading in Hong Kong on Monday, giving it a market valuation of $206 billion, the first time more than $200 billion. This is higher than Oracle's $190 billion, Amazon's $178 billion and IBM's $161 billion.

"If the chairman of a company starts selling, it probably means the market could start taking a beating," Tse added. "The market has risen so much, it was expected to come down at some point."

Ma sold 10 million Tencent shares on Thursday at an average of HK$162.26 each and another 10 million shares on Friday at an average of HK$159.81 each, according to two disclosure filings to the Hong Kong stock exchange.

Tencent reported a jump in online advertising revenue during the fourth quarter, buoying the outlook for higher earnings from its WeChat and QQ messaging services. Net income for the three months ended December rose 50 percent as Tencent develops its advertising, payment services, online games and content streaming businesses.

- Lighting products illuminate trade fair

- Canton Fair deals 'will be stable'

- Record fall in forex reserves during Q1

- Bull run in HK set to continue

- 'Belt and Road' takes new route

- Alibaba may face trouble in US as fakes abound

- 10 Red Dot Award winning carmakers in '14

- China key stock index touches new high