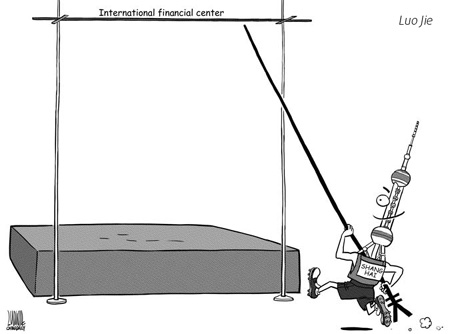

The central government recently declared its intent to build Shanghai, China's business hub in the eastern coastal region, into a global financial center by 2020. It set the goal as a national development strategy.

The emergence of Western financial centers in the past was largely a result of economic and urban development.

But not all large metropolises with a big economy become financial hubs. London and New York are global finance centers, Paris is not.

London was the earliest international financial hub and Britain left a lasting influence on the banking system and capital market, since most relevant rules, regulations and legal frameworks were formed in the country.

With the US economy becoming more powerful, the greenback eventually supplanted the British pound as the global reserve currency, and New York replaced London as the premier financial and trade center in the world. Despite the shift, the British framework that the financial system was built on did not change.

The underlying elements enabling New York to evolve into a top-notch global financial center were English language, the dollar and the Anglo-Saxon legal system. Smaller regional financial cities that emerged afterwards also had these traits, at least to a greater extent than their rivals.

London's recent comeback as a global financial center on par with New York was not because of a more popular British pound, but due to rising use of the greenback in Europe. The development of a dollar market in Europe offered a lot of opportunities for London.

Hong Kong and Singapore often rank higher on lists such as the global financial center index (published by the City of London Corp) than Tokyo because they have more English, a greater flow of dollars and a more Anglo-Saxon-style legal framework than Tokyo.

There are some minor offshore financial hubs such as the Cayman Islands, Iceland and Ireland, which have been flooded with financial capital in recent years due to their excessive deregulation.

But these tax havens are not genuine financial centers.

What kind of financial center should Shanghai be built into? Shanghai, though better positioned than Tokyo, is still far behind Hong Kong and Singapore as an Anglo-Saxon-style financial center.

But it is possible for Shanghai to become the first Asian-born financial center.

Economists predicted the gravity of the world economy will shift to the east in the first half of the 21st century and China will replace the US as the biggest advanced economy in the world.

Such a major change might remold the framework of financial centers and build Shanghai into a global financial center paralleling London and New York.

The establishment of an Asian economic community, the internationalization of the Chinese yuan and the decline of the US dollar will offer a great opportunity for Shanghai to become an international-level finance hub.

The development of Shanghai into a global financial center will be much like that of New York, and will boast similar historic significance.

The author is a professor with the China Center for Economic Studies, Fudan University. The article was reprinted from Shanghai Securities News

(China Daily 05/25/2009 page2)