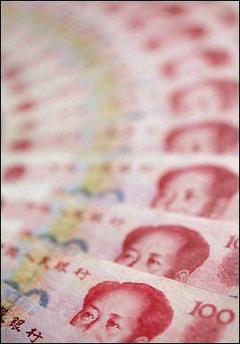

China to keep yuan basically stable in 2006

China's central bank vowed to keep the exchange rate "basically stable" in the coming year while allowing market forces to do their work, within limits.

Chinese yuan banknotes on display in Beijing. China's central bank vowed to keep the exchange rate "basically stable" in the coming year while allowing market forces to do their work, within limits. [AFP] |

The People's Bank of China made the pledge in its quarterly report, released on its website, while outlining objectives for the coming months.

"We will take the initiative to improve the managed float system in a gradual and controllable manner, and in accordance with the need for the stable development of the nation's economy and finance," it said.

"We will keep the yuan basically stable at a reasonable and balanced level, allowing the market forces to exercise their basic functions in forming the exchange rate."

The yuan's 11-year peg against the US dollar was scrapped in July last year in favor of a link to a basket of currencies.

Under the new rules, the central bank also began setting a daily central parity rate for the yuan against the dollar, allowing the currency to trade within 0.3 percent of that level.

Since then, the value of the currency has risen from 8.21 to the dollar to around 8.04.

But the United States has been pressuring China to further reform its currency regime, arguing the yuan remains artificially weak, giving the Asian giant an unfair advantage in global trade.

The report detailed other objectives for 2006, including gradually pushing for convertibility of the yuan on the capital account.

"We will increase the channels for inflows and outflows of capital and promote convertibility on the capital account in a stable manner," it said.

The yuan is convertible on the current account for trade in goods and services, but not on the capital account, which means exchanging yuan for purposes such as stock investment is more cumbersome.

The report also suggested the central bank will pay attention to the inflow of hot money, aimed at short-term speculative gains.

"We will strengthen efforts to monitor short-term fund inflows, and implement stable management of fund flows," it said.