Pension fund appoints Citigroup, Northern Trust

(AFP)

Updated: 2006-10-11 10:55

Shanghai - China's multi-billion-dollar National Social

Security Fund has selected US financial heavyweights Citigroup and Northern

Trust as its custodian banks for overseas investment.

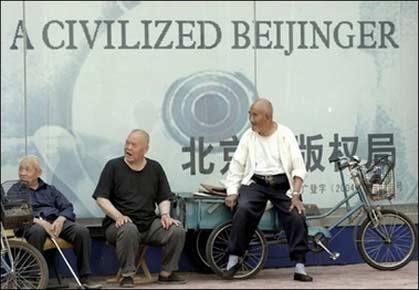

A group of elderly Chinese take a rest in Beijing. China's

multi-billion-dollar National Social Security Fund has selected US

financial heavyweights Citigroup and Northern Trust as its custodian banks

for overseas investment.[AFP] |

The fund secured approval in May to invest up to 44 billion yuan (US$5.5

billion), or 20 percent of the more than 200 billion yuan it has under

management, the fund said in a statement on its website.

A Citigroup spokeswoman, Marine Mao, confirmed the US-based banking group's

selection.

"It is only Northern Trust and Citigroup that have been selected," Mao said.

The Chinese national pension schemes are currently composed of global

equities, such as US and Hong Kong stocks, as well as fixed-income products.

Xiang Huaicheng, head of the national fund, said earlier that it would invest

up to US$800 million overseas by the end of the 2006, mainly focusing on

Hong Kong as well as US and European markets.

At the end of 2005, China had around 210 billion yuan in its national-level

pensions that fall under its social security system, mainly to fund living and

medical expenses for the elderly and the poor.

The funds is known to be greatly short of being able to provide for China's

fast-growing number of retirees.

Last month the top regulator for China's welfare system was said to be

mulling a new "market-based mechanism" in which independent fund managers would

be entrusted with the nation's pension money.

The decision came after Shanghai's Communist Party chief was fired for

suspected graft involving the city's retirement program.

Chen Liangyu was removed from his post and the Politburo over the misuse of

around a third of the city's 1.2-billion-dollar pension fund in what is one of

the biggest financial scandals in China.

|