Stamp vision

By JIN JING (China Daily)

Updated: 2007-06-04 06:51

Updated: 2007-06-04 06:51

SHANGHAI: After a series of monetary measures and repeated warnings, the central government is seen to be showing renewed resolve to cool the overheating stock market with fiscal measures that can have a more immediate impact.

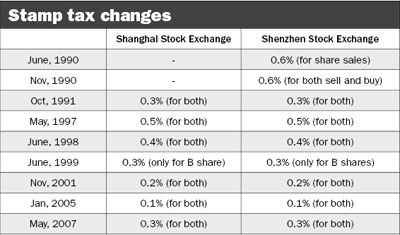

An increase in the stamp tax from 0.1 per cent to 0.3 per cent that was imposed last Wednesday, intended to help promote healthy growth in the securities market, was widely taken as a sign that the central government is serious about curbing excessive speculation by short-tem traders by raising the transaction cost.

"What is special for this year's stock market trading is that Special Treatment stocks or low-priced stocks performed better than large-capitalization blue-chip companies, showing that there are lots of speculators in the market," says Zhang Yidong, an analyst at Industrial Securities.

According to the statistics from China Securities Regulatory Commission, the A-share turnover ratio on the Shanghai Stock Exchange was as high as 392 percent, while that on the Shenzhen Stock exchange was 437 percent in the first four months this year. The turnover ratio shows the frequency of stock trading. "The high turnover rate indicates that there are many short-term speculators in the market," says Zhang.

"The stamp tax adjustment will have the effect of forcing people to switch their investments from the penny stocks to blue-chip stocks and Olympic-concept stocks, such as those in the transportation and infrastructure sector," he adds.

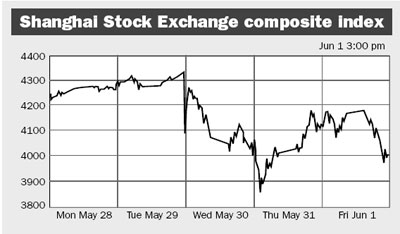

The Shanghai Composite Index dived 6.5 percent on Wednesday after the Ministry of Finance announced the tripling of the stamp tax from 0.1 percent to 0.3 percent. But buying momentum appeared just after the noon break on Thursday, pushing the main indicator up 1.4 percent to close at 4,109.65 yuan, led by banking stocks.

Large-capitalization stocks performed well even as the stock market took a dive.

Analysts say the sudden announcement of the stamp tax, which triggered one-day panic selling, would not have a lasting impact, as investors are standing by and seeing what action the government may take to cool down the market.

Song Wenguang, a private investor with more than 10 years stock trading experience, said that the tax adjustment will make him more cautious on the his stock investment. "I am worried about the proposed policy the government may take to intervene the market, such as a capital gains tax," says Song.

"I also bought some shares when the index dropped to a relatively lower point on Wednesday, and believe the index will rise in the near term," he adds.

"Unless the Chinese government takes continuous policy action, the recent A-share market correction will likely to be temporary," says Huang Yiping, head of Asia Pacific economics and market analysis at Citigroup.

"The psychological impact on investors could be larger than the actual effect of the tax adjustment. We think the policy change may add pressure on share prices in the near term, which could reduce the risk of a market crash," says Shen Minggao, an economist at Citigroup.

Capital continued to flow into the stock market, even after the tax adjustment announcement. The number of investor accounts crossed the 100 million threshold last Monday, as new accounts have reached as high as 36,000 a day.

"With the continuing large inflows of capital, the rise in the stamp tax will not change the upward trend of the stock market," says Zhang.

"With the continuing large inflows of capital, the rise in the stamp tax will not change the upward trend of the stock market," says Zhang.

But Huang notes that a potential significant correction in the stock market may result in the withdrawal of liquidity from the stock market into the property markets and bank deposits.

Similar actions have before been taken by the government, including in May, 1997, when it raised the tax from 0.3 percent to 0.5 percent. At that time, the stock index slipped as much as 500 points, or 32 percent, in the following four months until it later rebounded.

(China Daily 06/02/2007 page2)

|

||

|

||

|

|

|

|