Outdoor success

Updated: 2011-08-05 16:08

By Meng Jing (China Daily)

|

|||||||||||

Chinese companies can design products best suited to Chinese customers, he says.

Statistics from ISPO China, an international sports business network, show that Toread ran third in sales in China in 2010, after Columbia Sportswear and The North Face.

At its purchasing fair for next year's spring and summer products that ended in early July, the value of the company's orders totaled 482 million yuan, 66 percent more than in 2010.

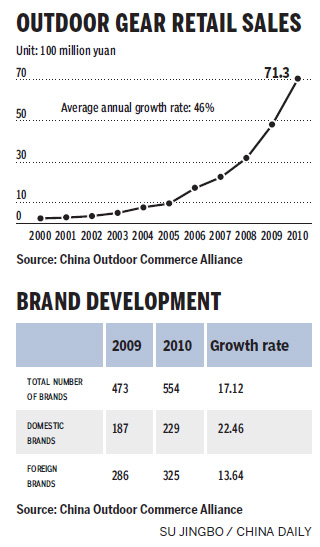

Despite the domestic industry's short gestation and its relatively small market share, the number of product makers has surged, reaching 229 in 2010. They have 325 Western rivals.

Columbia Sportswear, the outdoor product giant from the US, has

already witnessed heightened competition, a result of the thickly populated niche market.

"The Chinese outdoor market is unique in that it is relatively new and quickly evolving," says Scott Trepanier, PR and promotions manager of Columbia Sportswear. "Despite its relative young age, we see more brands competing in China than any other market."

International brands have dominated the market but, with more companies entering the fray the big brands' share of the pie has begun to shrink.

About 47.35 percent of market share was dominated by the top seven by sales numbers in 2010, compared with 55.81 percent in 2009, according to COCA.

Qi Jun, a veteran in the outdoor industry in China, now executive director of Realone-Sports, a Shanghai company that helps international sports brands expand sales channels in China, says fiercer competition is inevitable.

In China, most outdoor products are sold in department stores that have limited space for the outdoor category despite its growing sales, Qi says.

"At this point there is no room for newcomers at shopping malls in major cities A new one gets in, an old one has to get out."

Qi forecasts doom for Chinese makers because Western competitors have decades of experience in outdoor sports.

"They have the best expertise, technology and enough funds to support research and development."

Both The North Face and Toread invest 3 percent of their revenue in research and development, but the absolute dollars are clearly not on the same level, given The North Face's $1.5 billion projected revenue this year, bigger than outdoor product sales put together in China.

However, Sheng of Toread disagrees, saying it is wrong to give up when you have to compete with other people's advantages.

|

|

Annual sales of outdoor products reached 7 billion yuan last year, with foreign brands taking a lion's share. Zhang Xiaoli / for China Daily |

"Chinese companies are more sensitive about the swiftly changing market. The decision-making process is quick and flexible. The competition is a long run. It is too early to tell."