Investor shakes off bear market blues

Updated: 2012-02-24 07:40

By Chen Jia (China Daily)

|

|||||||||||

BEIJING - The experience of investing in the stock market last year was depressing for Wei Xinrong, a 52-year-old restaurant co-owner who is taking a wait-and-see attitude this year.

China's stock market, which dropped more than 21 percent last year, sucked more than 300,000 yuan ($48,000) out of Wei's account by the last trading day. In the first month of last year, Wei had 1 million yuan invested in five companies.

The Shanghai Composite Index, which tracks China's biggest stock exchanges, closed at 2852.65 on Jan 1 last year. It reached a high for the year of 3067.46 on April 18, then slipped to a three-year low of 2132.63 on Jan 6 this year.

"I expected the large-cap stock index would rise above 3500 in the past few months, but I felt disappointed when I saw the continuous declines," said Wei, who wanted to buy a house for her newlywed son. "But the loss forced me to give up the plan."

"There may be some problems in the stock market that need the attention of top officials," Wei said. "For example, it's unreasonable that so many new share prices drop below the issue price soon after the initial public offering."

"I would not like to call the stock market a 'machine for recycling money', but it seems that way."

This year, Wei wanted a better return for shares.

"After all, it hit bottom in January," she said.

Last year's bear market came mainly because of the long-standing tight monetary policies. They were supposed to soak up liquidity and beat inflation, but they also hurt share prices, said Lu Zhengwei, chief economist at Industrial Bank.

According to Jing Ulrich, chairman of global markets for China at JP Morgan Chase, it will be hard to change the bear market into a bull market in the first half of this year.

However, "there may be some good investment chances in some sectors, such as the retail industry, which may have 18 percent growth this year", Ulrich said.

In addition, Ulrich suggested investors keep a close eye on banks and energy companies listed on the A-share market.

"These shares now have relatively lower price-to-earning ratios of about eight, which means the expected return may be very high, depending on the stable expansion of these industries."

Hot Topics

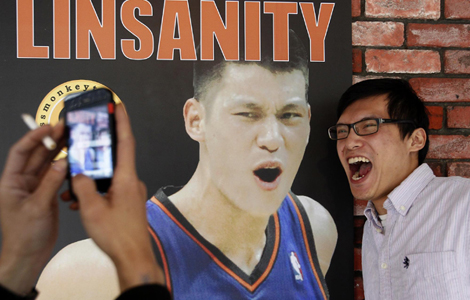

Wu Ying, iPad, Jeremy Lin, Valentine's Day, Real Name, Whitney Houston, Syria,Iranian issue, Sanyan tourism, Giving birth in Hong Kong, Cadmium spill, housing policy

Editor's Picks

|

|

|

|

|

|