Reorganized railways an engine for reform

Open for debate

Another key reason for dismantling the ministry was to break the monopolies that have existed within the network for more than half a century and introduce competition.

To achieve this, observers say the corporation needs to be further separated. How far that goes is open for debate.

Zhao Jian, a professor at Beijing Jiaotong University who specializes in the railway industry, suggested making the corporation into a parent company and establishing three regional operators, covering North, Central and South China.

"There should be no department above these three companies in terms of managing train services," to create a market-driven environment, he said.

Liu Bin, another researcher at the NDRC's Comprehensive Transport Institute, voiced a similar opinion in an interview with China Securities Journal. However, he added, "It doesn't matter how many companies make up the railway corporation. The key is to ensure there is competition along the major railway lines."

Others say they would go even further and separate the transport network for the business operation.

"Breaking up the China Railway Corporation by geographical location would only mean the monopoly switches from a national one to regional ones," Zhao Xu at the Unirule Institute of Economics told China Daily. He said allowing different companies to operate different routes, allowing them to cross over into each other's markets, would spur competition and create a market driven by the demands of passengers.

By contrast, Zhang said he would be hesitant about breaking the monopoly, citing the contribution the railways make to China's economy.

The consensus among researchers is that railway investment accounts for an estimated 2 to 3 percent of China's GDP growth.

"Putting all the emphasis on smashing the monopoly will harm the development of the railway economy in the long run," Zhang warned.

Public speculation

Among the public, changes to the way the railways are run has led to speculation over the future of ticket prices and freight costs.

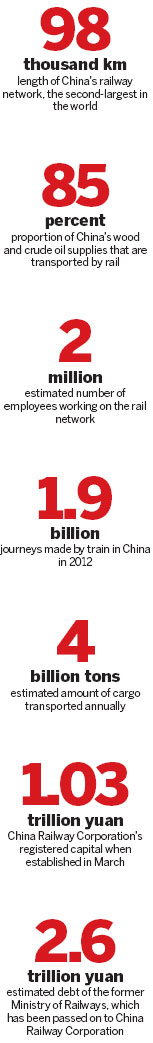

As China Railway Corporation is a purely profit-driven entity, and combined with the fact it has been saddled with the defunct ministry's huge debts, a price hike would be an understandable course of action. According to Sheng, the head of the corporation, rail tickets are generally priced at lower than market value.

However, any suggestion of an increase in the costs for passengers was dismissed by the NDRC last month. In a statement, the country's economic planner vowed that train stations nationwide will continue to charge according to government-set prices.

Still, some experts argue that a more effective pricing system will help the railways to better cater to the market and improve efficiency.

In a commentary published by Caijing magazine on April 1, Li Lin, who before the recent shakeup was a researcher at the ministry's Economic Planning Institute, agreed with the belief that an administrative body should be responsible for setting ticket prices, rather than the corporation or any other commercial operation, due to the impact it would have on the cost of commodities. Yet, he said, that does not mean prices should be fixed regardless of market demand.

"There should be a revision to the regulations that make sure prices cover the operating costs of the company and also stay within reach of the spending power of the average passenger," he wrote.

Li conceded that railway operators should get some say in determining the costs of passenger tickets and freight costs.

Despite the NDRC statement, a price hike at some point in the future is inevitable. "The cost of resources is rising, and will keep doing so, and there is no exception for railway transport," Zhang said.

The only way to constrain costs and avoid hitting passengers in the pocket, he added, is "if other modes of transport, such as air travel or highways, start to play a larger role".

China's 12th Five-Year Plan (2011-15) states that authorities will expand the national highway network by 25,000 km, bringing the total to about 83,000 km, as well as build 82 airports and expand 101 more by 2015.

The plan also sets out to solve the lack of cohesion between different modes of transport and promote hubs. (This month the State Council approved a pilot zone aimed at boosting the airfreight sector in Zhengzhou, capital of Henan province.)

However, the concern over ticket prices that erupted after the dismantling of the ministry shows, according to experts, that the reform will need to carefully balance public interest with the desire to make a profit.

"Under the old system, losses from public transport were offset by revenues from freight. As a commercial enterprise, the China Railways Corporation will be unwilling to continue to take the losses," said professor Zhao Jian at Beijing Jiaotong University.

"The problem can only be solved through subsidies from the State," he added. "The problem is, how much should those subsidies be?"

Xin Dingding contributed to this story.