New energy vehicles await fuel injection

|

|

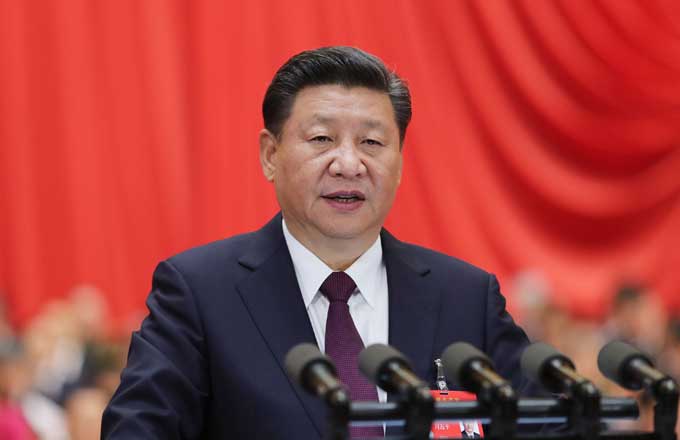

A visitor inspects a BYD new energy vehicle on display at the China (Shanghai) International Technology Fair. LAI XINLIN / FOR CHINA DAILY |

Market fails to gain traction as government subsidy policy on hold, reports Jiang Xueqing in Shenzhen.

Like many auto industry executives, Xu Weihan, chief financial officer of Shanghai Gaozhan New Energy Vehicle Sales Services, is anxiously awaiting a new government policy on subsidies for private purchases of plug-in hybrids and electric vehicles.

|

Charge point installation makes for a rocky ride Earlier this year, Li Weimin, who works for an auto services company in Shanghai, bought a Roewe E50 to assess the performance and weaknesses of electric vehicles. The all-electric model, made by SAIC Motor Corp, is priced at 234,900 yuan ($38,326). After deducting subsidies of more than 100,000 yuan, Li actually paid 149,500 yuan for the car, including tax and insurance. "Someone has to try out a new product like this," said Li, who also has a conventionally powered car. Li's Roewe E50 has covered more than 4,500 km since he bought it on Feb 26. The car has a range of 120 km in normal weather and traffic conditions, but that falls to around 70 km when the air conditioning is in use. However, installation of a charging pole on the permanent parking lot at his residential area took four months. The application procedure is extremely complicated, partly because demand is limited to a small number of individuals. "First, I sent an application to the property management company, which discussed the matter for two months before finally giving approval. Then I applied to a power supply bureau and Shanghai Municipal Electric Power for the electricity supply and installation of an electricity meter. In the end, I submitted a construction plan to the property management company for approval and arranged the wiring layout myself," he said. The distance between Li's home and office is 11 km. He usually charges his car once every three days, or on alternative days during hot weather when the air-conditioning unit will be in full use. Most companies that manage parking lots and residential areas do not allow the installation of charging poles because of the amount of space required. Once, charging poles were installed in front of service centers and offices of power supply bureaus in Shanghai, but now they're only installed at the request of individual drivers, according to Li. He suggested the government take the lead in coordinating work between the relevant departments and power companies to accelerate the construction of charging facilities and the promotion of electric vehicles. |

Because the new policy is up in the air, the company's business in the first half of the year has been greatly affected.

"Many customers who had signed orders have canceled their purchases," said Xu. "The tough situation forced some major auto manufacturers, such as SAIC Motor, to pay the subsidies first. They started doing that in July. They will apply to the government for reimbursement of the subsidies when the new policy is unveiled."

The Chinese government provides stronger support to new energy vehicles in terms of subsidies than any other in the world, said Pang Yicheng, CEO of Beijing EV Future Information Technology Co, an information provider for the electric vehicle industry.

In addition to the central government, a number of local governments have also formulated their own policies to encourage purchases of new energy vehicles. In December, the Shanghai municipal government, for example, set up a yearlong program to pay subsidies of 30,000 yuan for plug-in hybrids and 40,000 yuan for electric vehicles. To sweeten the deal even further, it also offers purchasers free license plates.

"Three years ago, we realized that China has no choice but to develop new energy vehicles because of concerns about the country's energy security," said Pang. "China is the fastest-growing auto market in the world. Car sales rose 12.3 percent year-on-year during the first half of this year. So the country has a sense of urgency about reducing oil consumption by vehicles."

Weak market

However, the market for new energy vehicles remains weak, despite the government subsidies.

Just 5,889 new energy vehicles - 5,114 electric vehicles and 775 plug-in hybrids - were sold in China between January and June, but 10.78 million vehicles of all types were sold in the same period, according to statistics from the China Association of Automobile Manufacturers.

By the end of March, the number of electric vehicles on the road had risen to more than 39,800 from 27,800 at the end of 2012, said Wan Gang, minister of science and technology, at an international forum in Shanghai earlier this year.

The figures are far below the central government's production and sales target to get 500,000 electric vehicles and plug-in hybrids on the road by 2015 and 5 million by 2020.

But why is it so hard to promote new energy vehicles to private buyers? The biggest problem lies in supply and demand, according to Zhang Junyi, principal at Roland Berger Strategy Consultants, who specializes in the automotive industry.

"Consumers are highly price-sensitive. Even if we take subsidies into account, the prices of new energy vehicles are still higher than those of conventional vehicles because of underdeveloped battery technology," he said.

For example, the price of the e6 model, an all-electric crossover car - half sedan, half SUV - manufactured by BYD Auto Co, is 369,800 yuan before subsidies. Although customers will receive a subsidy of 60,000 yuan from the central government and a further 60,000 yuan from Shenzhen's local government (although the local subsidy varies from place to place), the car is still more expensive than conventional gas-powered vehicles in the same category, which usually cost 100,000 to 150,000 yuan.

So far, around 3,000 to 4,000 e6s have been sold to private buyers, mostly in BYD's hometown of Shenzhen in Guangdong province.

"At present, we are mainly focusing on the public transport market. Once demand for the BYD e6 rises significantly in that market, we will move into mass production, which will benefit consumers by bringing the price down," said Wang Aihui, marketing director of the Green Public Transport Division of BYD Auto Sales Co.

The company has sold 820 e6 models for use as taxis and 500 as police cars, plus 935 of its K9 all-electric buses, in several cities, including Shenzhen, Changsha in Hunan province and Xi'an in Shaanxi province.