Global opinion leaders praise Xi's G20 speech

Updated: 2013-09-06 16:26

By Fu Jing and Xie Songxin in St Petersburg (chinadaily.com.cn)

|

|||||||||

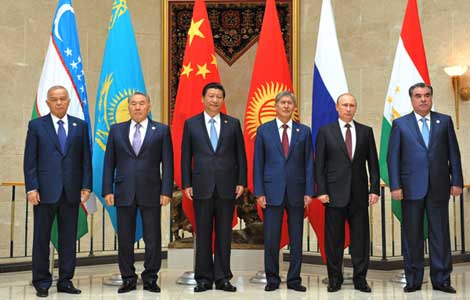

President Xi Jinping has brought the spirit of "pragmatism and boldness" in a cooperative way to the G20 summit when addressing the country's domestic difficulties and global challenges.

Global opinion leaders were commenting shortly after Xi, who made his G20 debut, delivered a keynote speech to the leaders'summit in St Petersburg on Thursday.

They said they were impressed by Xi's candidness and pragmatism in implementing structural reform at home even at the cost of a slower pace of economic growth and they also welcomed Xi's stance of requesting a greater voice and decision-making rights in global economic governance on behalf of emerging economies.

Gregory Chin, associate professor of political economics at York University in Canada, who has tracked several G20 summits, said that Xi brought a "new spirit of candidness and boldness" to the meeting.

"Challenging world conditions are prompting the Chinese leadership to take bold, careful and calculated global measures," said Chin, a Chinese-Canadian scholar who specializes in evolving global governance and China's role. "I found that this new spirit of boldness continues at the G20."

Chin said that Xi has been at the forefront of several recent important global engagements like the recent US-China Strategic and Economic Dialogue and had a successful meeting with President Barack Obama in the US.

Based on his observations, Chin said Xi's speech focused on encouraging growth in the world economy, and also on securing financial stability, international banking and other related financial reforms to enhance the role of emerging economies in the system.

Mikhail Golovnin, senior economist with the Russia Academy of Science said Xi inserted a spirit of both cooperation and competition at the G20 by coming up with the idea of "reforming the basket of currencies for special drawing rights."

Golovnin said this is a bold expression of internationalization of the Chinese currency.

"New currencies, such as the yuan, should be included in such a basket and make the system more competitive," said Golovnin, who is also an expert on Russia's National Committee of BRICS Research.

Currently, the dollar, pound, euro and yen make up the basket of global reserve currencies.

Douglas Paal, director of the Asia Program of the Carnegie Endowment for International Peace in Washington, said Xi's proposal of turning the G20 into a platform focusing on long-term governance is sensible, and is consistent with the efforts of the G-20 since the financial crisis.

Nicola Casarini, research fellow at the EU Institute for Security Studies, said Xi's speech aimed to both reassure the G20 partners about the state of the Chinese economy and the pace of economic reforms as well as to reiterate the demand for the reform of the quota system of the IMF.

"The two are intertwined. China's economic success – which has indeed benefited both the Chinese people and the world – has taken place in an international economic and monetary environment dominated by the West, in particular the US," said Casarini.

China has invested massively in dollar-denominated assets, thus making China vulnerable to decisions taken by the Fed.

Casarini said it is understandable that Chinese leaders see the reform of the IMF as a step toward a wider reform of the international monetary system.

This reform would be more in line with China's current development path, including preparations for the use of the yuan as a global reserve currency, an event that will allow China to be less dependent on the US economic cycle and the decisions taken by the Fed.

John Kirton, co-director of the G20 Research Group at the Munk School of Global Affairs at the University of Toronto, said from the beginning of the G20 summit, China played a central role in and it knows its own economic rise depends on financial stability, open markets and growth in the major economies of the G8 and its emerging partners in the BRICS as well.

"Xi expected the G20 leaders to improve monetary policy, cooperation and coordination, to ensure that the withdrawal of quantitative easing in the US does not spark an outflow from the emerging economies that further reduce their already slowing growth."

Kirton said Xi also expected the G20 to shift from its emphasis on strong, sustained and balanced growth to an approach that adds inclusive growth for all, because it knows that this is the way to increase domestic demand in China.

Jean-Paul Larcon, a professor of strategy and international business at HEC Paris, said the efficiency and transparency of the global financial system are maintaining conditions for long term global economic growth, but the reform process is quite slow at the level of institutions like the IMF for political reasons.

"So step by step pragmatic cooperation is also needed, such as new proposals made by the OECD on long-term investment financing by institutional investors," said Larcon.

Eswar Prasad, senior fellow of Global Economy and Development at the Brookings Institution said Xi has touched on the key issue of monetary policy.

"The reliance on monetary policies, and the implications for capital flow volatility remains a dominant theme at these meetings," said Prasad.

Prasad added that this is because the emerging markets largely view monetary policy in advanced economies as causing problems for them, and the advanced economies are basically taking the position that the emerging markets are chronic complainers.

Prasad said governance reforms therefore become very important, because unless the promised reforms are delivered on, it's going to be much harder for the IMF to credibly tell the emerging markets that it is neutral.

Chen Weihua in Washington, Zhang Yuwei in New York, Zhang Chunyan in London and Li Xiang in Paris contributed to this story.

Related Stories

Xi vows economic reform 2013-09-06 12:10

Xi aims to defend China's economic stability at G20 2013-09-06 08:56

Xi calls for closer G20 ties to boost world economy 2013-09-06 08:56

Xi aims to defend China's economic stability at G20 2013-09-05 21:34

Schedule