'Black banks' targeted in latest anti-graft crackdown

By Zhang Yan (China Daily) Updated: 2015-10-16 07:22

|

|

China Daily |

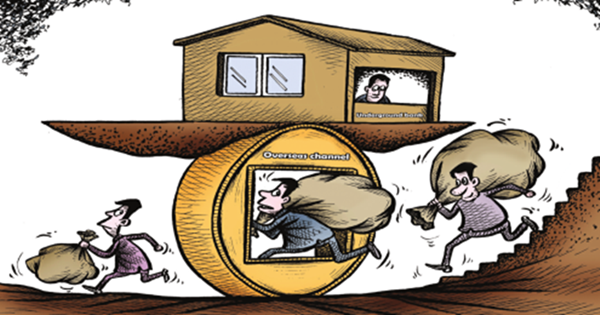

The central government is stepping up its anti-graft drive by cracking down on illegal lending and money-laundering operations in a bid to prevent outbound flows of stolen assets.

The Ministry of Public Security says "black banks" and illegal currency exchanges have facilitated the flights of a number of former government officials and senior managers of State-owned companies accused of corrupt activities. Most have absconded to popular destinations, such as the United States and Australia, where a lack of bilateral extradition treaties and differences in international law and legal process ensure they are safe from extradition.

At the end of August, the ministry began a three month operation targeting underground lenders, money launderers and offshore funds.\

Meng Qingfeng, vice-minister of public security, said the ministry will work closely with the People's Bank of China and the State Administration of Foreign Exchange to share information and establish a mechanism to coordinate and conduct rapid investigations into suspicious outbound flows of assets.

A special force will be established to combat underground banks and unearth evidence of economic crimes. The ministry will increase the flow of related information, and a series of educational events will be organized to show the public how to conduct overseas financial transactions through legal channels, Meng said.

Corrupt officials or business leaders secretly planning to leave the country have used a network of underground banks to send "millions of dollars" of illegally obtained assets overseas, according to officials.

The outflows pose a severe threat to national economic safety, so the government is determined to smash money-laundering operations and improve foreign exchange controls to maintain financial and political stability.

In April, the Public Security Ministry joined the PBOC and SAFE in a combined operation targeting underground money exchanges. So far, more than 230 suspects have been apprehended in many major cases, and more than 100 black banks have been closed down, ending operations thought to have netted about 670 billion yuan ($105.5 billion), according to the statistics released by the ministry.

Tip of the iceberg

Officials cited the case of Qiao Jianjun, a former director of China Grain Reserves Corp, and his wife, Zhao Shilan, as an example of economic crime.

In March, a US federal grand jury indicted the couple on charges of providing false documents to gain EB-5 immigration visas-which provides permanent residence for qualified foreign investors who guarantee to create jobs-to enter the US. The Chinese authorities also accused them of laundering money in China, according to the ministry.

In 2011, Qiao was being investigated on allegations he'd embezzled more than 300 million yuan, stolen national assets and accepted large bribes. He allegedly transferred the entire 300 million yuan overseas via underground dealers and fled with Zhao to the US, where they purchased properties in suburban Seattle. Zhao is now in FBI custody, but Qiao is still at large and being sought by US law enforcement authorities, the ministry said.

Qiao's case is one of many, according to officials, who said he is one of a large number of former high-ranking individuals who sent money abroad and then skipped the country. The ministry declined to say exactly how many officials have fled overseas, or estimate the value of misappropriated assets.

Last year, "Operation Fox Hunt", a six-month campaign targeting fugitives and suspects overseas, resulted in the return of 680 Chinese nationals-4.5 times more than in 2013-from 69 countries and regions, including the US, Australia and Singapore. Stolen assets valued at as much as 3 billion yuan were recovered, and most of the returnees are now under further investigation or face trial.

In April, the ministry started a new round of "Fox Hunt", and Interpol published a list of the 100 top absconders-77 men and 23 women-alleged to have been involved in corrupt practices.

To date, more than 150 people have been brought back to China from about 30 countries and regions to stand trial.

Ou Yangxiong, a senior official at SAFE, said black bank activity is so clandestine and the throughput of illegal assets so large that it's difficult to accurately assess the scale of the problem.

"A large amount of untraced cross-border capital has been 'freed' from the State's financial regulatory system. That has created a huge funding black hole that is seriously disrupting the nation's financial management and endangering economic security," he said.

- 14,528 Chinese pilgrims performed Hajj this year

- Former China work safety regulator expelled from Party

- 'Black banks' targeted in latest anti-graft crackdown

- Early harvest seen for Belt and Road

- Air cleaning effort pays off

- Govt to spend $22b on bringing 98% rural areas online by 2020

- Taiwan flight-transfer talks continue

- China vows to increase support for refugees

- Scientists sink teeth into history of humans in Asia

- Official urges right path for mainland-Taiwan relations development