Community bank aims to lift rural residents out of poverty

By Tan Yingzi (China Daily) Updated: 2015-12-18 08:29|

Workers process hot pepper sauce at Yiliuxiang Food Co in Shizhu county, Chongqing. The company is one of the beneficiaries of the poverty relief financial programs. Tan Yingzi / China Daily |

Zhang Xiaochuan is really passionate about solving rural China's financial woes.

Two years ago, he quit his job at a big bank in Shizhu county, Chongqing, and joined Chongqing Shizhu BOC Fullerton Community Bank as its director.

"I could have spent the rest of my life there very comfortably, but I love doing something valuable for society, such as helping the poor get rich," he said last month.

The community bank, established by Bank of China and Fullerton Financial Holdings of Temasek in June 2013, is in Shizhu Tujia autonomous county in eastern Chongqing.

The region's mountainous landscape has contributed to the poverty of its people. About 16 percent of its half-million residents live below the national poverty line of 2,300 yuan ($357) in annual income.

It is a huge challenge for the local government to eliminate poverty by the end of 2017, the goal set by Chongqing municipality.

This year, Zhang's bank has been working with the People's Bank of China's Fengdu branch, which is in charge of the business in Shizhu county, to develop a series of innovative financial programs for poverty relief.

The programs helped Brother Soldier Hot Pepper Co-op in Shuanghui village, Daxie county, to obtain a 700,000 yuan low-interest loan from the community bank so it could make timely payments to suppliers.

Established in 2008, the co-op has helped more than 1,500 families out of poverty through pepper farming.

"The community bank reached us and offered us very convenient services," said Li Weizhen, 45, one of the co-op's co-founders. "We got the money in a week and saved about 20,000 yuan in interest."

The "Shizhu model" works like this: The government deposits 5 million yuan in poverty alleviation money into the community bank as a guarantee fund. The community bank can distribute agricultural loans against fund deposits at a ratio of no more than 10 times, which means the bank can distribute 50 million yuan of such loans at most.

The PBOC Fengdu branch then provides the community bank with the capital through a refinancing program.

Insurance companies take part, too. Commercial insurance programs cover personal accidents for the participating families, while government programs cover their agricultural businesses.

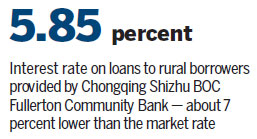

Borrowers must be approved by the Shizhu Poverty Alleviation Office, the PBOC Fengdu branch and the community bank. If approved, they receive an interest rate of 5.85 percent, about 7 percent lower than the market rate.

"Government funds are far from enough to solve the poverty problem," said Xiong Yi, director of PBOC's Fengdu branch. "We need to encourage more commercial banks to participate in the poverty alleviation financial services. After all, they know the market best."

So far, PBOC Fengdu branch has extended 60 million yuan in refinance loans to the community bank.

Zhang, in his 40s, said his bank's agricultural loan balance reached 220 million yuan at the end of September, a 42.5 million yuan increase from January.

Shizhu BOC Fullerton Community Bank is an independent legal entity, with a registered capital of 40 million yuan, of which 90 percent is from Bank of China and 10 percent is from Temasek's Fullerton.

Armed with Temasek's rich experience in micro-financial services in Asia and the Middle East, the community bank aims to serve small-and medium-sized businesses, mini businesses, local individual businesses, as well as farming and animal-raising households in the county.

- China vows to tighten crackdown on terrorism

- Chinese scientist among Nature's ten people for 2015

- Physicists on cutting edge in search for dark matter

- Top information office holds record number of news conferences

- Shenzhen leaps to top of efficiency list in 2 yrs

- China aims to expand global FTA network

- Year's worst smog coming to north China

- China launches satellite to shed light on invisible dark matter

- China strongly opposes US arms sale to Taiwan

- Report: Layoffs may loom next year