Countries shopping for Chinese shoppers

By Erik Nilsson (China Daily) Updated: 2016-01-05 07:57They were there one minute and - presto! - they weren't.

They'd vanished into shops to cuddle scarves and wriggle footwear over their toes.

Houdini would've poked a thumb skyward at their vanishing acts.

Our Portuguese tour guide labeled one word "dangerous" - "shopping". She was half joking yet completely exasperated with members of our Chinese media group disappearing into Porto's boutiques and big-brand stores en route to the next site.

The guide had a contractually obligated itinerary.

These Chinese wanted to buy more than see or do.

Places like Porto will shift from barely registering on Chinese tourists' radars to places where Chinese home in on cash registers. Budding shopping destinations will bloom this year, as the seeds they've sown take root.

Indeed, Chinese shopping overseas was one of the global tourism industry's top stories last year. About 88 percent of the $165 billion Chinese spent overseas last year was on shopping, the China National Tourism Administration reports.

China's biggest online travel agency, Ctrip, forecasts Chinese will spend $3,500 per capita this year, as the number of outbound Chinese reaches 130 million.

Japan's word of the year for 2015 comes from China. (Well, actually, from Chinese visitors.) Bakugai - "explosive shopping", referring to inbound Chinese customers - beat out 50 proposals for the top spot at publisher Jiyukokuminsha's 2015 U-Can New Words and Buzzwords Awards.

Chinese spending in its neighboring nation grew 165 percent to nearly $9 billion during the first nine months. It blasted to $834 million during the National Day Golden Week, when it generated 0.1 percent of Japan's GDP.

The biggest uptrend came from Down Under, where Chinese spent an average $21 million a day, surpassing Australian tourism authorities' goals half a decade early.

Shopping in South Korea is so rigorous that China's e-commerce titans JD.com and Alibaba are contending to foster online-shopping programs enabling Chinese to buy Korean goods from home.

The UK destination Chinese visited most after Buckingham Palace was the Bicester Village luxury outlet. Chinese accounted for 20 percent of global spending in London's West End.

This phenomenon is poised to project further and farther this year, when more Chinese will likely spend more money in more places. Take Lisbon's Freeport outlet as an up-and-comer.

It recently hired a Chinese consultancy and plans to recruit Mandarin-speaking staffers. Freeport expects Chinese to jump from 10 percent of global visitors last year to 50 percent this year. Its tourism center even offers hot water to suit Chinese preferences.

"It's like this all over Europe," Freeport's director, Nuno Oliveira, told me. "In terms of culture, it's easy to figure out what people like and don't like. The most difficult thing is language."

Freeport put 20 people through Mandarin training in the fall. Yet most couldn't get past ni hao (hello).

Still, it's a start - a literal and figurative greeting to Chinese customers. Such emergent shopping destinations around the world seem set to, well, emerge this year. They're preparing to open their registers wider, as more Chinese visitors arrive, wallets open.

Perhaps more languages will mint new words for it.

- Hanoi protest over test flight rejected

- PLA 'needs to boost its readiness'

- Govt mulls making retirees pay health insurance

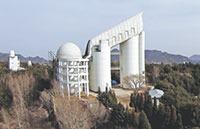

- Watch this space: Telescope releases mass of data

- Beijing to work with neighbors to improve water quality

- China steps up crackdown on food and drug safety crimes

- Phones and drones - China's risk-takers who rule the world

- Rescue work continues to reach trapped miners

- China's 2nd aircraft carrier totally different from Liaoning

- Structural reform to power China's stable growth: Finance minister