Subprime crisis not a 'direct threat'

As financial markets across the globe brace for another week of uncertainty triggered by the US subprime mortgage crisis, analysts are confident that China, especially the mainland, will be able to hold its own.

Experts are of the view that China may not be directly hit by the crisis as a result of its strong economic fundamentals, limited exposure to this particular variety of assets, and the mainland's restricted linkage with the international financial system. But they warn that if the subprime housing mortgage crisis snowballs and results in a severe economic downturn in the West, Chinese exports may be indirectly hurt in the longer term.

Subprime lending refers to loans to people who have poor credit histories and low incomes. These high-risk housing mortgages thus come at high interest rates. Over time, these mortgages have come to be bundled into other forms of securities and sold in the global credit markets.

The genesis

The current crisis began as subprime mortgage defaults began to spiral as a result of higher interest rates and the bursting of the US housing bubble. With the US Federal Reserve consistently raising interest rates, borrowing costs there have risen from 1 percent to 5.25 percent in just two years. Increasing defaults and foreclosures have taken down one US housing mortgage company after another since late 2006.

But the wider problem is that banks, mostly in the US and Europe, have bought much of these repackaged subprime debts, with serial defaults and bankruptcies reducing the value of this asset and making it difficult to resell it. At least five hedge funds have blown up, including two of Bear Stearns and two by Australia's Macquarie Bank Ltd. France's BNP Paribas has suspended three investment funds while two Goldman Sachs Group hedge funds are also reportedly suffering subprime-related losses.

In China, two of the Big Four banks have admitted to having been affected by the subprime crisis. Though neither Bank of China nor China Construction Bank has disclosed the extent of their exposure to the subprime market, Bank of China has said its losses could be "several million US dollars".

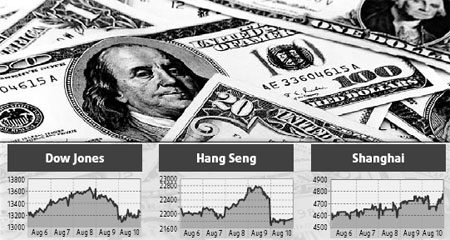

The US turmoil and fears of a global credit squeeze have been dragging down regional stocks for weeks. Japan's Nikkei 225 Stock Average has slid for four straight weeks while Hong Kong's Hang Seng Index has had its biggest weekly loss in five months. South Korea's Kospi has posted its biggest one-day loss in three years and Australia's key index has hit the lowest mark in six years.

Only mainland stocks have so far stood firm. Drawing succor from this resilience of A shares, analysts are confident that this problem has very little chance of spilling over to the mainland.

Jun Ma, China chief economist of Deutsche Bank, said: "There's very little linkage between China and subprimes except through a few financial institutions. Share prices have already reacted to the subprime issue, I would say overreacted in some cases. The impact is mainly sentimental."

Contagion

But what happens if Wall Street crashes? Because of its close connection to the US financial market, won't Hong Kong be hit as well in that case? And if Hong Kong catches cold, how long will it be before Shanghai sneezes?

Chen Xingdong, chief economist of BNP Paribas Peregrine Securities Ltd, admitted that Hong Kong may take its cue from Wall Street but maintained Hong Kong might be hurt a little less this time because of the mainland money circulating in its market.

"As for mainland investors, they are relatively inward-bound, their money is still largely in Shanghai. Hong Kong and Shanghai are still loosely related."

Ma goes a step further. According to him, A-share and H-share markets react to different stimuli. "The mainland market is driven by liquidity and company earnings. The H-share market is dominated by foreign investors. If you look at recent share movements, you'll see Shanghai and Hong Kong are, in fact, negatively correlated."

Ricky Tam, chairman of Hong Kong Institution of Investors, also points out this tendency of Hong Kong and Shanghai exchanges to swing in opposite directions. "Despite the increasing contacts between Hong Kong and Shanghai, the effect on the mainland will be minimal. If Hong Kong keeps going down, Shanghai may of course be eventually affected, but not that much."

Professor Raymond So of Chinese University of Hong Kong, like BNP's Chen, believes even Hong Kong may not be affected that much. "Though the international markets are more integrated than ever before, markets are still ruled by fundamentals. Hong Kong companies are making money and the economy is in good shape."

But So added a rider to his upbeat outlook. "If US companies lose money in subprimes, they will go back to their investment funds for redemptions. Fund managers will then have to sell their stocks to raise the cash demand. When they start doing that, they will sell international stocks as well. So even if Hong Kong or Shanghai shares are fundamentally strong, their prices will start falling."

Long-term worries

But more than a possible, eventual slide in share prices, So is worried about the long-term impact on Chinese exports. "Subprime is essentially an American crisis. But if the US economy is hurt, American demand for foreign goods and services will slow down," he said.

Chen also pointed out that more than 30 percent of Chinese exports head for the US, and that's the real potential headache for China as far as the subprime saga goes.

But Ma believes even that is not a big problem. "Chinese exports have become less reliant on US. Europe is now a bigger market," he said.

"We have calculated that a 6 percent slowdown in Chinese exports may result in a 1 percentage point slowdown in Chinese GDP. But even in the case of a bigger slowdown, China can exercise its options to stimulate the economy."

(China Daily 08/14/2007 page15)