Mainland, Hong Kong lure multinational HQs

Companies based in the Asia-Pacific region are beginning to favor the mainland and Hong Kong as preferred locations for their regional headquarters (RHQs), however Singapore still remains the top choice.

The findings were revealed in a survey of more than 100 global companies based in the region by Spire Research & Consulting, one of Asia's leading strategic intelligence consultancies.

"The survey findings are consistent with the thinking of multinational companies (MNCs), based on our experience of working with them on regional business planning projects over the past few years - for example the trend of dual regional headquarters for North and South Asia," Spire's Group Managing Director Leon Perera, said.

Approximately 60 percent of respondents operate in at least three Asian markets, and nearly a third operate in seven or more.

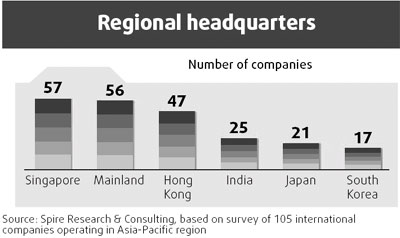

Singapore, the mainland and Hong Kong were respectively preferred as RHQ locations over the other Asian markets. India, Japan and South Korea followed in fourth, fifth and sixth place.

More than half of the respondents ranked Singapore as among their top location choices for RHQs, mainly because of economic policies, infrastructure and political stability. Infocommunications technology, lifestyle and leisure are the main industries that rank Singapore as the best location.

Interestingly many companies are splitting the RHQ function into two zones, seeing Singapore as a South Asian RHQ, and Hong Kong as a North Asian RHQ.

The mainland, which came a close second to Singapore, received 56 votes compared to Singapore's 57 for attractiveness as an RHQ location.

The mainland is an attractive option for international manufacturing companies, which account for roughly half of the mainland's manufactured exports.

Companies prize the mainland as an RHQ location for its proximity to production facilities. About 30 global companies reportedly have their RHQs in Shanghai alone, including General Motors, Visteon and Fuji-Xerox.

Hong Kong was third in line with 47 votes, the special region claimed to host 1,228 RHQs as of September 2006, compared to over 4,000 that conduct their global and regional functions in Singapore. The major lines of business of the RHQs in Hong Kong are wholesale, retail and import/export trades, business services, transport and related services.

Shanghai and Beijing compete for investment. By the end of 2006, 154 MNCs had set up RHQs in Shanghai and 181 in Beijing. MNCs are increasingly lured by Beijing, Shanghai, and even Guangzhou to locate their RHQs there, as all three cities - together with the Ministry of Commerce - provide attractive RHQ schemes with generous incentives such as tax rebates/exemptions, special distribution and export/import rights and wider market access to MNCs.

The past few years have witnessed several MNCs - including AMD, Honeywell, Fuji Xerox, General Motors, Goodyear, IBM and UPS - uprooting their RHQs in Hong Kong, Singapore or even Japan and relocating them to mainland cities.

Shanghai's advantages include its strong manufacturing base for electronic and automotive products, a large port, excellent general infrastructure and a good support system of international schools for the children of expatriate executives.

"Beijing is being eclipsed, as Shanghai has a lot of neighboring cities such as Suzhou, which are already manufacturing bases for many multinationals," Zhao Hong, a researcher with the Beijing Academy of Social Sciences (BASS), said.

But Beijing's Financial Street is now home to major investment banks such as Goldman Sachs, UBS and JPMorgan.

Beijing also is renowned for its brainpower. Many of the country's top universities are located in China's capital, providing a large pool of available recruits.

In the longer-term, the question may not be one of Shanghai versus Beijing, but of what kinds of RHQ will locate in Shanghai and Beijing. After all, China is so large a market that competing hubs can still thrive by focusing on their respective strengths.

(China Daily 12/07/2007 page15)