Oil and banks still a drag on stock market

Most stocks listed on the mainland rose yesterday but the main index fell as concern about Pudong Development Bank's fund-raising plans hurt banks, and high oil prices hit refiner Sinopec Corp.

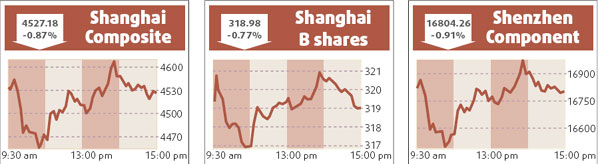

The benchmark Shanghai Composite Index ended down 0.87 percent at 4527.177 points, though it was well off its low of 4452.675 after bouncing from technical support on its 250-day average at 4459.

Turnover in Shanghai A shares shrank to a moderate 100 billion yuan from Wednesday's 114.4 billion yuan.

"Though the index has support around the 250-day average, it is still likely to drop below that area eventually as the weakness spreads from banks to property shares," said Chen Jinren, analyst at Huatai Securities.

Pudong Bank tumbled 5.98 percent to 43.23 yuan, adding to Wednesday's 10 percent limit-down plunge.

Other bank shares were down in sympathy with Pudong Bank, with Huaxia Bank off 3.75 percent at 17.19 yuan.

Sinopec dropped 4.43 percent to 17.90 yuan, as this week's fresh highs for international oil prices could shrink its refining margins. Traders said the stock was also hit by rumors that it might plan a fund-raising.

Property shares were very weak with Vanke sliding 3.82 percent to 25.20 yuan. Merchants Property Development, which sank 6.15 percent on Wednesday after announcing an 8 billion yuan share issue plan, tumbled a further 7.38 percent to 56.50 yuan.

Airline shares underperformed because of high oil prices. Air China lost 3.76 percent to 21.01 yuan.

Among gainers, Baoshan Iron and Steel rose 4.07 percent to 18.41 yuan on expectations that it would announce a rise in quarterly steel product prices.

Suning Appliance Co gained 1.23 percent to 69.85 yuan after the China Securities Journal said it had set expansion plans for the next three years.

HK creeps

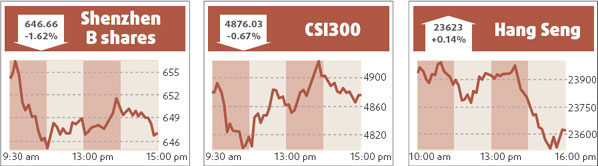

Hong Kong blue chips eked out a 0.1 percent gain yesterday, having erased most of their earlier advances as investors came to terms with a deteriorating outlook for the US economy.

The benchmark Hang Seng Index rose 32.42 points to end at 23623 on mainboard turnover of HK$75.4 billion compared with Wednesday's HK$89.7 billion. The China Enterprises index of H shares, or Hong Kong-listed shares in mainland companies, was flat at 13561.88.

"In the long run, the picture is bearish," said Alex Wong, director at Ample Finance. "I think we'll go below 23000 points next week, and even 22000 is possible."

Agencies

(China Daily 02/22/2008 page15)