Stocks surge on talk of stamp tax cut

The Shanghai stock market jumped 2.06 percent yesterday, as investor expectation of a stamp tax cut intensified.

The Chinese People's Political Consultative Conference (CPPCC) agenda includes the stamp tax adjustment proposal, the official Securities Times reported. The CPPCC opening ceremony was held yesterday.

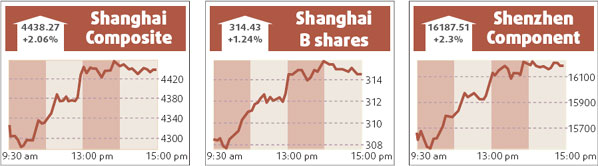

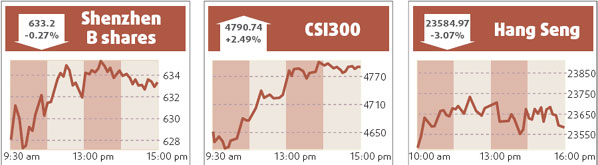

The benchmark Shanghai Composite Index rose 89.73 points to close at 4438.27. The Shenzhen Component Index surged 2.3 percent, or 363.63 points, to close at 16187.51.

Turnover on the two bourses amounted to 183.4 billion yuan, up 6 percent from last Friday.

Analysts said expectation of the stamp tax cut has raised investor sentiment. Meanwhile, three new mutual funds were approved last Friday that are expected to inject fresh capital into the market.

"Expectation of medical and environmental industry reform, which will be discussed at the CPPCC and the NPC (National People's Congress), also pushed up stocks in those sectors," Wu Feng, an analyst at TX Investment Consulting Co Ltd, said.

Nanjing Pharmaceutical Co Ltd surged 9.55 percent to close at 16.97 yuan and Shanghai Pharmaceutical Co Ltd soared 8 percent to close at 13.16 yuan.

Environment-protection equipment manufacturer Fujian Longking Co Ltd rose to the daily limit to close at 23.09 yuan.

Small- and medium-sized companies also performed well yesterday.

However, analysts said the ripple effect of neighboring weak markets cannot be ignored.

Hong Kong's Hang Seng Index slid 3.07 percent to close at 23584.97 yesterday, following US stocks.

In Tokyo, the Nikkei 225 Stock Average tumbled 4.49 percent to close at 12992.18.

"But the mainland stock market is not expected to fall as sharply as other markets have because mainland stocks are valued lower compared with two months ago," Zhu Haibin, an analyst at Essence Securities, said.

Meanwhile, the new board for emerging companies on the Shenzhen bourse is expected to be launched in the first half and is likely to divert capital from the main board, analysts said.

"The market is expected to be more volatile in the weeks to come," Wu said.

(China Daily 03/04/2008 page15)