Property rebound buoys Hong Kong stocks

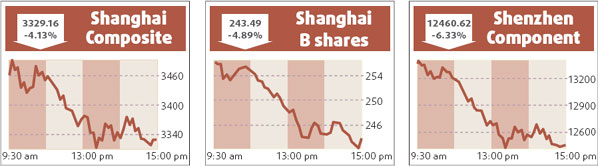

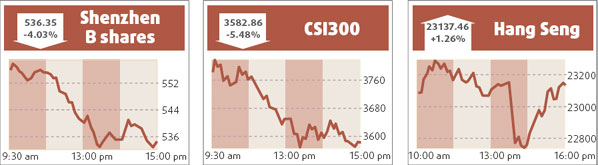

Hong Kong stocks rose yesterday, buoyed by property plays, but trade was volatile as a slide in Shanghai and $19 billion in new writedowns for Swiss bank UBS rattled investors.

The benchmark Hang Seng Index ended up 1.26 percent at 23137.46. The index seesawed in and out of positive territory, rising as much as 2 percent at one point.

The China Enterprises Index of Hong Kong-listed mainland companies, or H shares, finished up 1.27 percent at 12237.36.

"The gap between the A shares and H shares has narrowed since the beginning of the year," said Alex Tang, research director at Core Pacific-Yamaichi International. "And with the meltdown in A shares (yesterday), the H shares may follow."

"Adding to the pressure is profit taking after the market's strong performance last week," Tang said, referring to the index's 10.3 percent gain last week.

Mainboard turnover was HK$78.03 billion, up from HK$74.5 billion on Monday.

"The market should continue to trade between 22500 and 23200," said Patrick Yiu, associate director at CASH Asset Management.

Traders said the additional writedowns at UBS proved the US subprime crisis was far from over, further clouding an already murky outlook for the market this year. Hong Kong stocks ended their worst quarter in six years on Monday.

"The real concern in the Hong Kong market will be whether there is going to be additional writedowns of this size," said Conita Hung, director of Delta Asia Financial Group.

Property stocks rebounded after lagging recently due to investor concerns that further interest rate cuts may not be forthcoming.

Sun Hung Kai Properties, Asia's top developer by market value, climbed nearly 2 percent to HK$123.8, while billionaire Li Ka-shing's property flagship Cheung Kong gained 2.53 percent to HK$113.3.

Hang Lung rose 1.27 percent to HK$27.9.

But traders doubted that the gains signaled a long-term rebound for the sector.

Meanwhile, a pullback in crude oil prices bolstered airline shares, as well as Chinese refiners squeezed by State-controlled gasoline and diesel prices.

Sinopec Corp, Asia's top refiner, ended up 2.4 percent at HK$6.82.

Air China gained nearly 4 percent to HK$6.83, while China Southern jumped 1.32 percent to HK$6.17. Hong Kong's dominant carrier Cathay Pacific climbed nearly 2 percent to HK$15.6.

Agencies

(China Daily 04/02/2008 page15)