Carlyle bids for TheFaceShop

Carlyle Group, Bain Capital LLC and Advantage Partners LLC were picked to submit final bids for South Korean cosmetics maker TheFaceShop, said four people familiar with the matter.

CCMP Capital Asia Pte Ltd also made the shortlist to bid for the Seoul-based company being sold by Affinity Equity Partners Ltd, said the people, who declined to be identified before a buyer is chosen. SK Chemicals Co may join the bidding, two of the people said.

|

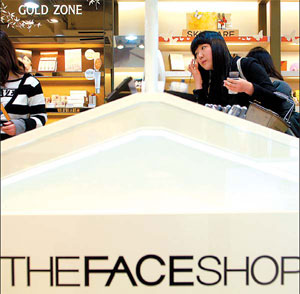

Customers look through cosmetics at TheFaceShop in Seoul. Bloomberg News |

TheFaceShop faces increased competition from LG Household & Health Care Ltd, Amorepacific Corp and ABLE C&C Ltd in South Korea's cosmetics and skin care market. Buyers may be drawn by the company's prospects for expansion in China, said Park Sehick, a fund manager with Hanwha Investment Trust Management Co.

South Korea is in a very good geographical position to expand overseas, especially with its proximity to China, the economic leader of the coming decades, said Sehick, who helps manage the equivalent of $1 billion and is based in Seoul.

Affinity controls 70 percent of TheFaceShop and founder Jung Woon-Ho owns the rest. The company may fetch $350 million to $450 million, people familiar with the bidding process have said.

Kim Mi Yeon, a spokeswoman at TheFaceShop, and Matilda Lee, a Seoul-based spokeswoman for Affinity, declined to comment. Spokespeople for the bidders either declined to comment or weren't available.

Slowing Growth

The sale, the second by Affinity in South Korea since December, comes as the country's retail sales growth slows and consumer confidence falls. Goldman Sachs Group Inc last month cut its 2008 economic growth forecast for the nation to 4.8 percent from 5 percent.

Affinity in December led a group selling Himart for 1.95 trillion won ($1.97 billion) to Eugene Corp, the nation's biggest maker of ready-mixed concrete.

TheFaceShop was established in 1962 and has about 500 shops in Korea and 17 other markets, including China, Japan, the US and Singapore, according to the company's website. TheFaceShop sells what it calls "naturalistic cosmetics", including skin-care creams, makeup and hair conditioner.

Affinity, spun off from UBS AG's private equity firm in 2004, bought control of TheFaceShop in October 2005, said Affinity's Lee, who declined to comment on the sale and pricing details.

The sale would also follow the travails in South Korea of private equity firm Lone Star Funds, whose former country head Paul Yoo was jailed on Feb 1 for stock price manipulation.

HSBC Holdings Plc, Europe's biggest bank by market value, wants to buy Lone Star's 51 percent stake in Korea Exchange Bank for $6.45 billion, with final approval subject to outstanding court appeals.

Agencies

(China Daily 04/17/2008 page17)