High crude price helps up firm's earnings

Halliburton Co, the world's second-largest oilfield contractor, said first-quarter profit rose 5.8 percent as crude pushed beyond $100 a barrel, prompting customers to increase exploration and production spending.

Net income climbed to $584 million, or 64 cents a share, from $552 million, or 54 cents, a year earlier, Houston-based Halliburton said yesterday in a statement.

The number of drilling rigs active outside North America rose 6.5 percent as US oil futures traded 68 percent higher than a year earlier. High prices allow oil companies to tap reserves that otherwise would be too small or too expensive, boosting demand for oilfield services.

"You've got oil averaging $97 a barrel," said Gene Pisasale, who helps oversee $25 billion in assets, including about 682,000 Halliburton shares, at PNC Capital Advisors in Baltimore. "That means marginal prospects from a year or two ago look a lot better."

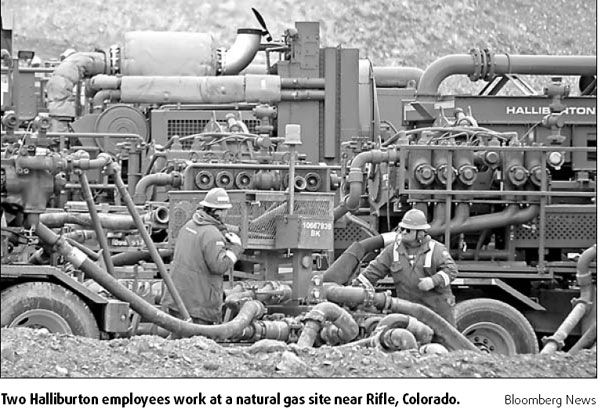

Halliburton, its bigger rival, Schlumberger Ltd, and other oil contractors provide technology, equipment and expertise for crude and gas exploration and production. Drilling activity is an indicator of demand for their services.

Halliburton's revenue rose 18 percent to $4.03 billion as sales gains outside North America made up for pricing pressures in the United States, Chief Executive Officer David Lesar said in the statement. He said more growth is coming.

Demand outlook

"The fundamentals of the world oil and gas market are projecting that the next leg up in the extended cycle is near," said Lesar.

Schlumberger, based in Houston and Paris, on April 18 reported a 13 percent gain in first-quarter profit. Baker Hughes Inc, the No 3 oilfield-services company, is scheduled to report its results today.

Profit from Halliburton's largest division, which helps clients maximize production from established fields, rose 11 percent, according to the statement. Demand strength in the Middle East and Latin America made up for a 2 percent decline in North American business and a "relatively flat" environment in Europe, Africa and the former Soviet Union, the company said.

Earnings from drilling and evaluation services climbed 6.1 percent. The segment includes drill-bits, drilling fluids and directional drilling, which allows a customer to change the direction of a well to better target a reservoir.

Worldwide, the number of active rigs rose 2.4 percent from a year earlier, with most of the gains occurring in South America and the Eastern Hemisphere, according to a count by Baker Hughes. North American drilling activity climbed 1.4 percent, driven by a 2.1 percent increase in the US.

Halliburton is adding research and training centers from Russia to Singapore as it diversifies away from North America, which accounted for 47 percent of revenue last year.

Agencies

(China Daily 04/22/2008 page17)