Search for a new int'l credit rating system

|

Guan Jianzhong, chairman and CEO of Dagong Global Credit Rating Co Ltd |

Reworking the current system means paying more attention to the lessons learned from the global credit crisis

Editor's note: On June 26, 2010,the fifth G20 summit opened in Toronto, Canada. In the summit the international community has reached consensus to reform the existing international credit rating system. On June 27 Chinese President Hu Jintao called to "develop an objective, fair, reasonable and uniformed method and standard for sovereign credit rating, so that the rating result can precisely reflect a country's economic situation as well as its level of credit risk." He said thatthe supervision of the credit rating agencies should be enforced and the regulations and accountability system on credit rating agencies should be strengthened.

One year has passed. Asthe world economy is yet to recover from the global financial crisis broke out in 2008, and some European countries and other economies are still in the shadow of a debt crisis, Guan Jianzhong, chairman and president of Dagong Global Credit Rating Co Ltd, China's leading credit rating agency, has given his analysis of the crisis the reason behind it and suggestions on how to reform international credit rating system.

Developed countries account for more than 90 percent of total government debt worldwide, and now control the world's debt system and use their influence in international credit ratings.

This dominance in the rating system is one reason the global credit and financial crisis hit in the first place: the developed countries assigned themselves the highest credit rating against their actual solvency, concealing their credit risks from investors, and thereby setting off the big credit bomb globally.

In three years, that debt crisis in finance has turned into a global economic crisis.

The current international credit rating system must take part of the blame for the crisis, so, reforming that system is key to global credit recovery.

We need to speed up work on a new credit rating system, with innovative ideas, to ensure the security of the global finance system.

The development of the global economy in those three years also proves the need for systemic reform.

Developed countries

The 15 countries that account for 59 percent of global gross domestic product (GDP) - the United States, Canada, Iceland, Ireland, the United Kingdom, Germany, France, Italy, Spain, Austria, Belgium, Portugal, Greece, the Netherlands, and Japan - are the economies that have suffered the most serious damage.

When faced with the crisis, these countries all relaxed their monetary policy to nearly zero interest and employed other unprecedented stimulus policies.

When the economic regulations were nearly exhausted, the expected economic recovery did not happen and the statistics of all of these 15 countries, in 2010, were far from optimistic.

Their GDP was $42.3 trillion, a slight growth of 16.4 percent from 2006, while total government debt amounted to $40.2 trillion, up 45.1 percent from the same year.

Meanwhile, the total amount of government debt accounted for 94.9 percent of GDP, compared with 77 percent in 2006; and 262.2 percent of government revenues, compared with the previous 92.4 percent.

Economic growth in these countries fell far short of debt growth, which continued to rise. Financing costs also tended to go up because of the increased risk in national debt repayments.

The driving force behind economic growth was not clear in most developed economies, and this meant gloomy prospects.

The United States - the world's biggest debtor nation, when confronted with the unsolvable sovereign debt crisis, recklessly turned to its money-printing machine, another likely cause of global economic deterioration.

Emerging economies

In comparison, the 15 major emerging countries and regions that account for 25 percent of global GDP - Russia, China (including Taiwan and Hong Kong), South Korea, Thailand, Indonesia, Singapore, Malaysia, Iran, Saudi Arabia, Algeria, Brazil, and Argentina - which also suffered greatly in the crisis, nonetheless have their strong wealth-producing abilities, as was demonstrated by their ability to withstand the crisis.

By the end of January 2010, their total foreign exchange reserves amounted to $5.5 trillion, an increase of 89 percent from the end of 2006. The same year, total estimated GDP was $15.5 trillion, up 41 percent from 2006.

These emerging debtor nations, in fact maintained the stability of the international credit system by relying on their own strengths.

They continued to provide funds and commodities to support the developed debtor nations that suffered heavily from the crisis. This in turn helped avoid a complete breakdown of the international debt system.

The recent economic situation has proven that this crisis differs from any previous crisis in history, by being the first global credit crisis to take place against a background of credit globalization.

The current international credit rating system favors those debtors who can set credit rating standards and give themselves the highest rating - without considering the real solvency issue. This system is at the root of a deepening crisis.

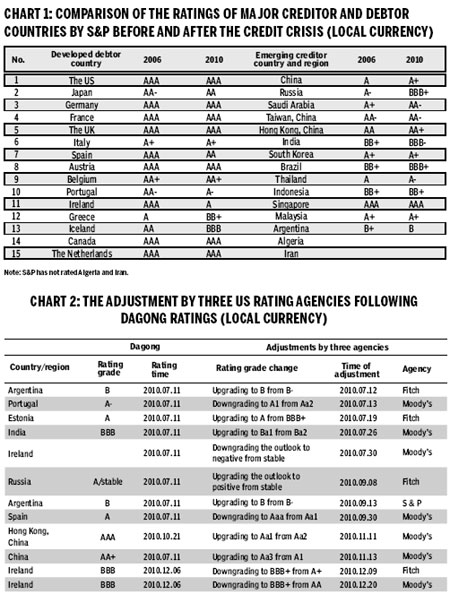

It is easy to see the favor shown to debtor countries, from the credit ratings of major creditor and debtor nations released by Standard & Poor - one of three US credit rating agencies (see chart 1).

The United States, to take one example, has adopted what it calls a quantitative easing monetary policy, which reflects the decrease of its real national solvency, and the dramatic decline in the government's willingness to repay its debts.

An international credit rating agency should respond to this, but the three American agencies chose to remain silent.

In this way, they supported the US government in its plundering of creditors, by using its muscle to issue the international reserve currency.

These agencies have betrayed international investors and their interests, proving yet again that they are the faithful servants of the biggest debtor nations.

The credit system - involving both creditors and debtors - is the economic basis of modern society, and the security of the credit system depends on whether credit rating agencies can correctly reveal the risk of default in those debtors.

Necessary funds cannot flow efficiently unless creditors are confident in their investment after credit ratings make a completely impartial judgment of the credit risk.

Under this principle, we are proposing that we create a new international credit rating system, one that can help the world choose the right path to economic recovery and avoid repeating past mistakes.

Dagong Global Credit Rating Co Ltd has been active in promoting such a reform, and we published the research results of the previous five years, on July 11, 2010.

This lead to a New Sovereign Credit Rating Standard, along with the credit ratings of 50 countries. This could shift the direction of the international credit rating system and point it toward a more rational goal.

Half a year after Dagong issued its ratings, the top three US rating agencies - Moody's, Standard & Poor, and Fitch - adjusted their ratings for 10 countries, in agreement with Dagong, providing further proof of Dagong's impartiality (see chart 2).

Guiding principles

In reworking the international credit rating system, attention should be paid to the lessons learned from the global credit crisis.

We need to follow developmental patterns of credit economies and take human society into consideration in a holistic way.

To this end, we have outlined the following principles:

Globalization

Credit globalization makes it much more likely that local credit risks will escalate and become a global crisis.

So, disclosure of credit risks in each individual country is closely connected to credit security in other countries. Each country's credit rating system needs to be an integral part of the global system.

With globalization, since every country is part of the global credit chain, it is impossible for a rating agency in one particular country to do their own research on risk analysis without sharing information with others.

Those who take on the historic responsibility of building a new international credit rating system should plan a global risk management system that can truly guarantee the safe development of humanity.

Independence

The international credit rating system should focus on risk problems in sharing information and should provide a clear warning of impending credit crises.

The independence of the international credit rating system is vital to this mission.

This principle calls for the international credit rating system to represent the interest of all members of the international community, instead of merely satisfying the interests of certain countries.

A prerequisite of the rating agencies that represent the international credit rating system and their highest priority is to protect the public interest, rather than speaking for a few special interest groups.

The international credit rating system should disclose risks based on objective research, instead of letting themselves be influenced by political ideology or interests.

Credit rating needs to be a business chartered by government and recognized by the market, and should in no way be a tool of free market competition. Rating agencies should not resort to such competitive practices as price wars or trading terms.

To ensure the impartiality of ratings, there need to be certain measures, such as technical and professional codes, to standardize the behavior of rating agencies.

Consistency

The core of an international credit rating system is the credit rating standards. There need to be international, unified standards to ensure the consistency of credit ratings.

International regulation

There is a need for regulators for an international credit rating system and a unified set of rules. Individual nation's regulations have to be subordinate to international regulations. They cannot take their place.

New model

I spoke on Building a New International Credit Rating System at the Bo'ao Forum for Asia, in April 2009. And, today, I feel that the logic behind that international rating system model is still valid.

Even after the idea of reform becomes a part of mainstream consciousness, we still need to look for new models.

A new system can have three components: an international credit rating regulatory organization; an international credit rating agency; and international credit rating standards.

An International Credit Rating Regulatory Commission can be established within the International Organization of Securities Commissions, and each country should have a credit rating regulatory body.

This organization should be responsible for developing an international credit rating system, providing global regulatory rules, giving guidance on regional credit rating systems, normalizing rating agencies' behavior, and improving rating standards.

An International Credit Rating Agency is needed, composed of rating agencies for each country. It can be responsible for setting unified international standards, rating multinationals, and taking part in ratings in various countries to help them check for and prevent credit risks.

As regards of rating standards, the International Credit Rating Regulatory Commission can devise a rating standards development plan and the International Credit Rating Agency should work on the standards and encourage rating agencies in each country to implement these or improve on them.

(China Daily 06/27/2011 page14)