Plans aired for overseas real estate investment funds

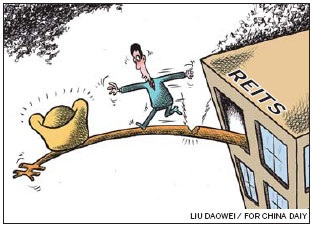

SHANGHAI - Catering to a craving for overseas property assets by mainland investors, at least two companies have applied to the Chinese authorities to sell real estate investment trusts (REITs) under the qualified domestic institutional investors (QDII) scheme.

The ban on domestic REITs is unlikely to be lifted anytime soon after the outbreak of the sub-prime mortgage crisis in the United States in 2008, which resulted in a global credit squeeze, analysts said. But the resulting economic downturn that has continued to trouble many developed economies seems not to have dampened Chinese investors' interest in snapping up prime properties in Hong Kong, London or New York.

Pending approval from the China Securities Regulatory Commission are the Lion Fund, managed by Shenzhen-based Lion Fund Management Ltd, and the Penghua Fund, run by Penghua Fund Management Ltd, also based in Shenzhen, according to a report in Caijing magazine. Both funds were established with the explicit purpose of investing in overseas properties.