Lower taxes to aid economic growth

BEIJING - Experts predict that the government will make structural tax cuts to shore up the world's second-largest economy in 2012, as they forecast slower growth amid weaker export demand and the threat of bad loans from stimulus spending.

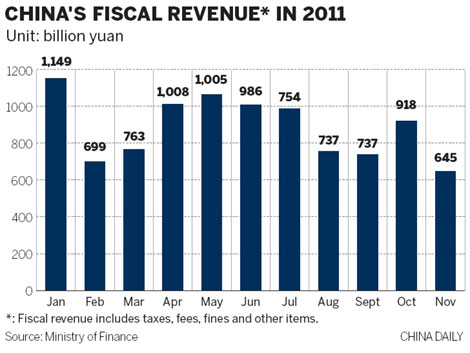

Banks ranging from China International Capital Corp (CICC) to Goldman Sachs Group Inc to Barclays Capital have forecast that Premier Wen Jiabao will cut taxes, after fiscal revenue surged past the government's target.

Lower levies will spur consumption without the bad-debt risks triggered by a record 17.5 trillion yuan ($2.8 trillion) of lending in 2009 and 2010 that funded infrastructure projects and real-estate speculation.

"China is no longer able to rely on massive investment in infrastructure building to stimulate the economy," said Yao Wei, a Hong Kong-based economist with Societe Generale SA. "Tax cuts are unavoidable."

Chi Fulin, head of the China Institute for Reform and Development, said that a new round of fiscal and tax reform, which has gained a high degree of consensus, still requires resolve and action from the government.

The economists made their forecasts as top Chinese leaders mapped out policies for 2012 at the annual Central Economic Work Conference.

Xu Shanda, former president of the taxation authority, said further structural tax cuts, in addition to existing policies, will help boost domestic consumption.

Xu said to reach the goals of the 12th Five-Year Plan (2011-2015), the government needs to cut taxes by 300 billion to 500 billion yuan.

China has taken steps to lower personal-income and service taxes, while increasing the energy resources tax to achieve emission targets.

The personal-income tax threshold rose in September to 3,500 yuan a month from 2,000 yuan, reducing the number of taxpayers by 60 million, according to the Ministry of Finance.

Also in September, the State Council approved a change in the energy resources tax that increased revenues by broadening the incidence.

The government also raised the poverty threshold for rural residents by 81 percent, to 2,300 yuan a year, making 128 million citizens eligible for subsidies.

Jin Dongsheng, deputy director of the tax institute under the State Administration of Taxation, said the trial program of reducing levies for service industries in Shanghai will benefit not only local businesses but also set off a nationwide chain reaction.

"The trial in Shanghai and other pilot cities (for taxes), such as house duties, should be introduced nationally to restructure the tax system and slash revenues to boost purchasing power," he said.

Consumption taxes and corporate-income levies might be cut, while rates might be raised for some industries to achieve energy-conservation and emission targets, said Peng Wensheng, the chief economist at CICC.

Bloomberg News contributed to this story.

China Daily

(China Daily 12/14/2011 page13)