2nd phase oil reserve is set for completion

Eight additional storage bases will provide total capacity of 170 m barrels

BEIJING - China will finish building the second phase of its strategic oil reserve project this year, providing a total storage capacity of 170 million barrels, China National Petroleum Corp (CNPC), the nation's biggest oil producer, said on Thursday.

The second phase will have eight storage bases, the CNPC Economics & Technology Research Institute said in a report released on Thursday.

The energy major said earlier that two bases of the second phase opened in 2011, while the other six were still under construction.

The first phase was completed in 2009, with a capacity of 103 million barrels at four facilities in coastal areas.

The third phase is scheduled for completion by 2020, which will take the total reserve capacity to 500 million barrels.

The reserves are intended to reduce the risks that arise from volatile crude oil prices and a growing reliance on imports.

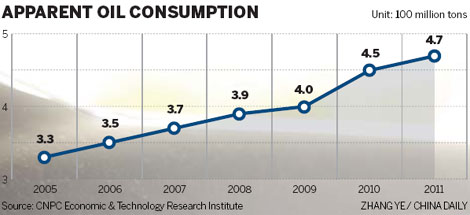

Net oil imports by China, the world's second-biggest oil user, rose 7.7 percent last year to 264 million metric tons. The import-dependency rate reached a new high of 56.3 percent, according to Dai Jiaquan, deputy head of the institute.

CNPC projected that domestic oil demand would grow 5 percent to 493 million tons in 2012, with net crude oil imports up 6.4 percent to 266 million tons.

China's leading oil companies, including CNPC, China Petrochemical Corp and China National Offshore Oil Corp, or CNOOC, are expanding their reach overseas to tap more oil resources.

Wu Mouyuan, an engineer with the Overseas Investment Environment Research Department of the CNPC research institute, said that Chinese companies' overseas output based on equity totaled 85 million tons of oil equivalent in 2011, up more than 10 percent year-on-year.

CNPC alone achieved equity output of 51.7 million tons of oil equivalent abroad last year.

Wu said that China's investment in oil overseas covered more than 40 countries and ranged from the upstream sector, which involves exploration and production, to the downstream, where oil is refined into products such as gasoline, diesel and jet fuel.

Entering 2012, CNPC saw uncertainties in the global crude oil situation, given the escalating tensions between Iran and the US and Europe.

Chen Rui, a CNPC oil researcher, projected that the price of West Texas Intermediate crude would average $100 a barrel in 2012, compared with $95 last year. Chen said the rise would mostly be driven by an improving US economic situation.

Brent crude, produced in the North Sea, would slide to about $95 a barrel this year from $111.23 last year, as the ongoing eurozone debt crisis would hit the region's economy.

Chen added that the West might impose long-term sanctions on Iran, which could force more countries to find ways to cut dependence on oil and lead to a gradual slide in global demand.

In addition, CNPC said that China's natural gas consumption would surpass 150 billion cubic meters (cu m) in 2012, exceeding Iran as the world's third-biggest market.

Domestic demand would reach 110 billion cu m, while imports would be 45 billion cu m, it said.

To reduce dependence on imported oil and gas and ease energy security risks, analysts suggested that China accelerate its efforts to explore for unconventional natural gas, in particular shale gas.

China Daily

(China Daily 02/10/2012 page13)